Q2 GDP crosses expectations Can figures be trusted?

03-12-2025 12:00:00 AM

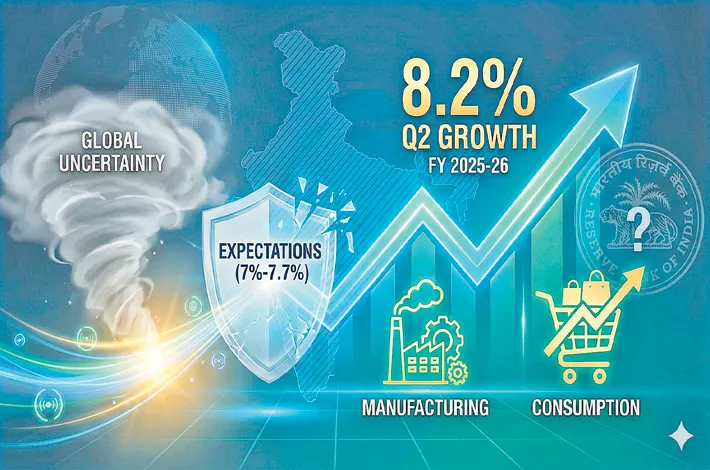

India’s economy delivered a stunning surprise on Friday, clocking real GDP growth of 8.2% year-on-year for the July–September quarter (Q2 FY25), sharply higher than the 7.8% recorded in Q1 and well above consensus forecasts that hovered around 7–7.3%. The Reserve Bank of India itself had projected just 7% for the quarter. The blockbuster print marks the second consecutive quarter of massive positive surprises and has lifted the outlook for full-year FY25 growth comfortably above 7.5%, with some economists now eyeing even higher numbers if global headwinds ease.

Experts attributed the outsized growth to multiple factors. Public capital expenditure continued to act as the crucial pillar, while a booming real estate sector pushed the “financing, insurance, real estate and professional services” segment past the 10% mark for the first time in recent quarters. Construction also remained robust. Chief Economist at a private bank, called it “a massive pickup that has beaten all estimates.”

She highlighted manufacturing GVA surging to 9.1% (against expectations of moderation) and services again delivering a 9%-plus performance, adding that the RBI now finds itself in a “very comfortable position” on the growth front. Another senior banker pointed out that consumption momentum stayed strong even before the recent GST rate cuts took effect, with rural demand showing clear signs of revival.

Corporate earnings, though flat sequentially, remained at elevated levels and supported the manufacturing jump from 7.7–7.9% in Q1 to 9.1% in Q2. Both economists noted the role of a sharply lower GDP deflator — driven by negative WPI and subdued CPI (around 1.7%) — in statistically boosting real growth numbers. Nominal GDP for the quarter came in at a still-respectable 8.7%, better than Q1.

Fiscal deficit and revenue outlook: Centre on track, states may slip

Analysts expect the Centre to comfortably hit its target, helped by a bumper RBI dividend, higher-than-expected non-tax revenue and savings from just-in-time cash management. However, net tax collections are likely to fall short by around Rs 1.5 lakh crore, largely because of generous income-tax relief in the new regime and the recent GST rate rationalization. The delayed India–US trade deal and elevated American tariffs remain the biggest external risk. Economists noted that Indian exporters front-loaded shipments earlier in the year, blunting the impact so far. The US share in India’s goods exports has already slipped from 24–25% to 21–22%.

At the same time, there was a sharp divide between those celebrating the number as proof of India’s resilience and those who branded the official statistics “suspect” and “inflated”. A Congress leader cited the latest IMF World Economic Outlook that once again flagged serious concerns over India’s GDP methodology and data quality. Reminding that the IMF and World Bank are not casual observers, he expressed concerned about their remarks that the data used to determine GDP is of very low quality and that the methodology was suspected.

He also referred to a former Chief Economic Adviser’s earlier academic paper that had estimated India’s growth may have been overstated by around 2–2.5 percentage points in previous years. He attacked the unusually low GDP deflator used by Indian authorities, which has hovered near zero or turned negative in recent quarters because of a heavy reliance on the wholesale price index (WPI). He opined that nominal GDP growth is now a better guide than real GDP, adding that the absence of corresponding job creation exposed the hollowness of the headline figure.

Another share market expert described the print as “a major surprise” that beat even the most optimistic forecasts. He highlighted a sharp ramp-up in private consumption – much stronger than anticipated – and noted that the headline growth came despite a contraction in government consumption expenditure, suggesting genuine underlying domestic demand strength. Another economist took the skepticism further, arguing that persistent issues with arriving at an “adequate GDP deflator” were largely responsible for the attractive real growth figure. Nominal GDP growth, he pointed out, actually slowed marginally from the previous quarter to 8.7%.

The counter-offensive for the political criticism however came swiftly from the pro-government side. A BJP inclined economist dismissed the criticism as ideologically driven and pointed out that even if one were to accept a hypothetical 2 percentage point overstatement, India would still be growing at 6–6.5% — a pace no other major economy, including China, is currently managing amid global trade wars and protectionism.

With two consecutive blowout quarters, India has cemented its position as the fastest-growing major economy. Underlying momentum in manufacturing, construction, real estate and services appears broader and stronger than anticipated. While global trade uncertainties persist, domestic drivers — led by public capex and an incipient private investment and consumption recovery — have put the economy on a much firmer footing than most forecasters believed just months ago.