RBI deployed $5 bn to boost rupee

17-10-2025 12:00:00 AM

The interventions helped the rupee post its biggest single-day advance in four months on Wednesday

FPJ News Service mumbai

The Reserve Bank of India (RBI) is estimated to have sold $3 to $5 billion in spot and non-deliverable forward markets to support the INR on Wednesday, according to traders. This marks its largest intervention in the last few months. The apex bank had repeatedly underlined that it has been keeping a close watch on movements of the INR, and would take appropriate steps, as warranted.

Notwithstanding the robust domestic macroeconomic fundamentals, the INR has witnessed some depreciation accompanied by phases of volatility. Seven traders from private, state-run and foreign banks provided the estimates, with two suggesting sales of $5 billion, citing significant activity in the non-deliverable forward market. The RBI did not respond to an emailed request for comment.

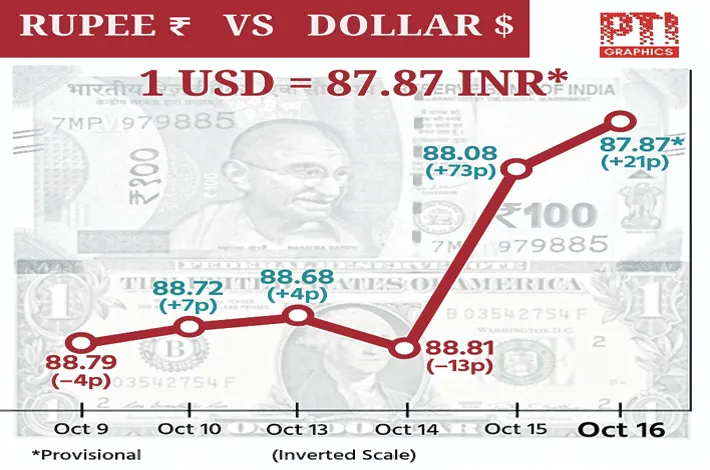

According to a report by Reuters, the interventions helped the rupee post its biggest single-day advance in four months on Wednesday. The rally continued into Thursday, with the currency reaching an intraday high of 87.70 per USD. The rupee had depreciated “beyond expectations, and Wednesday’s RBI move, though bigger, was not entirely surprising,” said Alok Singh, group head of treasury at CSB Bank in Mumbai. The exact scale of the RBI's intervention is difficult to determine since it operates through multiple state-run banks, and non-deliverable forward activity is harder to measure.

Traders rely on market volumes, price action, and the behaviour of banks handling RBI flows to estimate intervention levels. Brokers provide post-market clues about volumes executed by specific banks. Interbank market and broker volumes spiked on Wednesday amid the volatility triggered by the RBI's actions, bankers said.

Rising for the second straight session on Thursday, the INR appreciated 12 paise to close at 87.96 against the USD, buoyed by a softer American currency against major currencies and renewed risk-on sentiment among investors.

At the interbank forex market, the rupee opened below the 88-mark at 87.76 against the greenback, and touched an intraday high of 87.68. The domestic unit finally settled at 87.96, registering a rise of 12 paise over its previous close. On Wednesday, the rupee bounced back sharply by 73 paise to close at 88.08 against the US dollar, posting its biggest intraday gain in nearly four months.

Dilip Parmar, Research Analyst at HDFC Securities said the rupee notched a second consecutive day of gains, buoyed by a softer dollar against major currencies and a broader shift towards risk-on sentiment. Foreign fund inflows and strategic central bank intervention provided a significant tailwind to the currency's recent advance.

Ahead of the forthcoming holiday, the rupee is poised to tread water within a constrained range. However, its subsequent direction hinges entirely upon the dynamics of dollar flows and any tectonic shifts in the global geopolitical landscape. In the near-term, spot USD/INR exhibits support at 87.60 and resistance at 88.70. Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.21 per cent lower at 98.58.