Rupee plunges 48 paise to close at 87.66 per US dollar

05-08-2025 12:00:00 AM

The domestic currency declined during the day on demand for dollars from Oil Marketing Companies

PTI mumbai

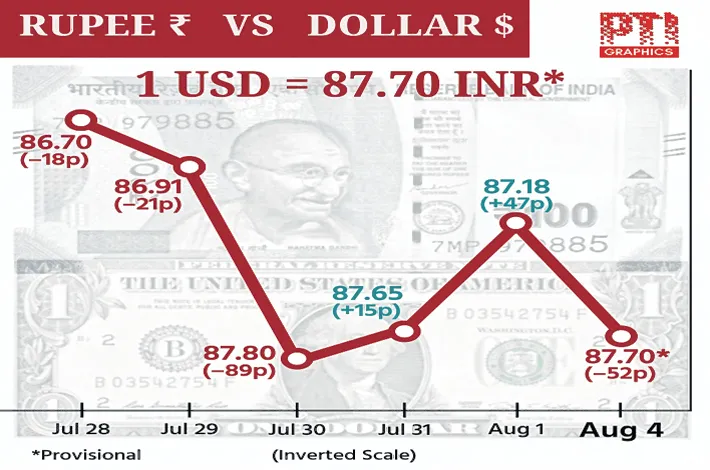

The rupee depreciated 48 paise to close at 87.66 against the US dollar on Monday, as sustained foreign fund outflows and trade tariff uncertainties dented investors' sentiment. Forex traders said US President Donald Trump's tariffs triggered fresh concerns over a much wider disruption in the global trade landscape.

The domestic currency declined during the day on demand for dollars from Oil Marketing Companies (OMCs). At the interbank foreign exchange, the domestic unit opened at 87.21 against the greenback, touching an intra-day low of 87.73 against the American currency. At the end of Monday's trading session, the domestic unit was at 87.66, down by 48 paise over its previous close.

"We expect the rupee to remain weak amid uncertainty over India-US trade deal and FII outflows. However, weakness in the US dollar amid chatter over rate cut expectations in the US amid weak economic data may support the rupee at lower levels," said Anuj Choudhary - Research Analyst, commodities and currencies, Mirae Asset Sharekhan.