Sentiment optimistic amid better Q1 results

05-08-2025 12:00:00 AM

FPJ News Service mumbai

Markets edged higher on Monday supported by strong performance in the metal and auto sectors. The 30-share Sensex gained 418.81 points to settle at 81,018.72 with 26 of its components closing higher and four down. During the day, the index climbed 493.28 points to hit an intraday high of 81,093.19. The 50-share NSE Nifty jumped by 157.40 points to close at 24,722.75. In the intraday session, it rose 169.3 points to hit a high of 24,734.65.

“A weakening US dollar, along with robust monthly auto sales and encouraging quarterly results from leading automakers, helped renew investor interest in these sectors,” said Vinod Nair, head of research, Geojit Investments. The Q1 earnings summary, Nair said, indicates that consumption-driven companies are benefiting from a rebound in volume demand. Meanwhile, rising unemployment and slower job creation in the US have reinforced expectations of a potential Fed rate cut. However, there still remains room for caution due to high US tariffs. There is a correlation between Indian and US stock markets in terms of daily price movements as FPI sentiment largely depends on price movements in both markets.

In the near-term, the market is in uncharted territory. Analysts said a clear direction will emerge on news surrounding the US-India trade deal happening after the next round of negotiations. From the global market perspective, indications are that a rate cut from the Fed in the September FOMC meeting is likely after the latest jobs report indicating declines in job additions in July and downward revisions in the jobs created in May and June.

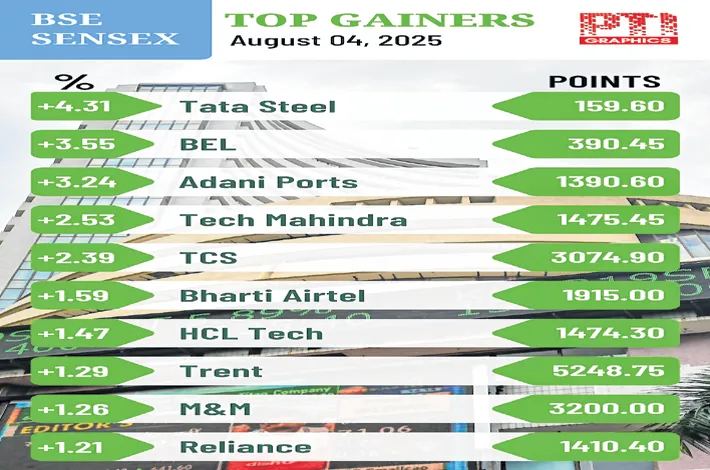

The US economy is slowing down, and the Fed is likely to respond with a rate cut in September. With the inflationary impact of the tariffs kicking in, a stagflationary scenario for the US cannot be ruled out. The market will respond to incoming data and evolving outlook. Tata Steel was among the top gainers, up 4.31%. TCS, BEL, Adani Ports, Tech Mahindra, Bharti Airtel, HCL Technologies, Trent, M&M, Reliance Ind, UltraTech Cement and L&T were the other major gainers.