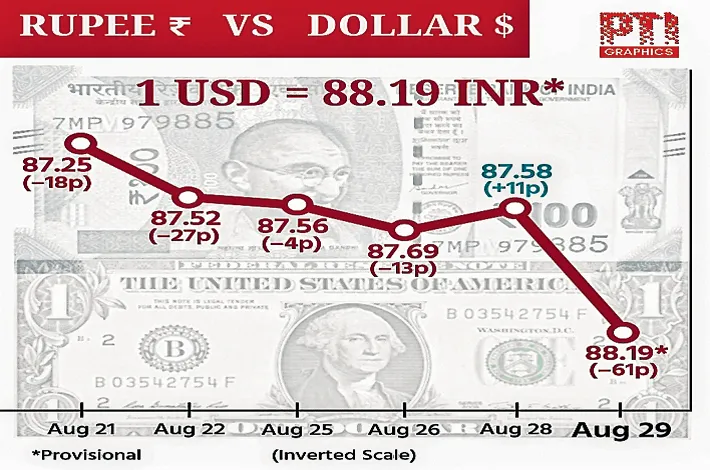

Rupee tumbles to new low on tariff concerns

30-08-2025 12:00:00 AM

The rupee breached the 88-mark for the 1st time and closed at an all-time low of 88.09 as against the US Dollar on Friday

Business Desk MUMBAI

The Indian rupee is an actively traded currency because it accounts for more than 1.5% of global foreign exchange market turnover, indicating its depth in global foreign exchange markets. The government’s limited external debt moderates currency and capital flight risk, and India never speculates on.

Despite these encouraging macros, the rupee breached the 88-mark for the first time and closed at an all-time low of 88.09 as against the USD on Friday, registering a sharp decline of 51 paise amid intensifying Indo-US trade deal uncertainties and tensions. The sentiment is cautious as worries grow over the 50% punishing tariffs on Indian goods exported to the US, effective from Aug 27.

“The weakening rupee is “definitely about the tariffs”, said Michael Wan, senior currency analyst at MUFG, calling the 50% rate “a meaningful negative for India”, a report by Financial Times, said.

The RBI sold dollars on Friday to support the rupee, according to two traders with knowledge of its actions, although it was not as aggressive as it had been in the past. The rupee has fallen 3% against the dollar this year, making it Asia’s worst-performing major currency, the FT report said.