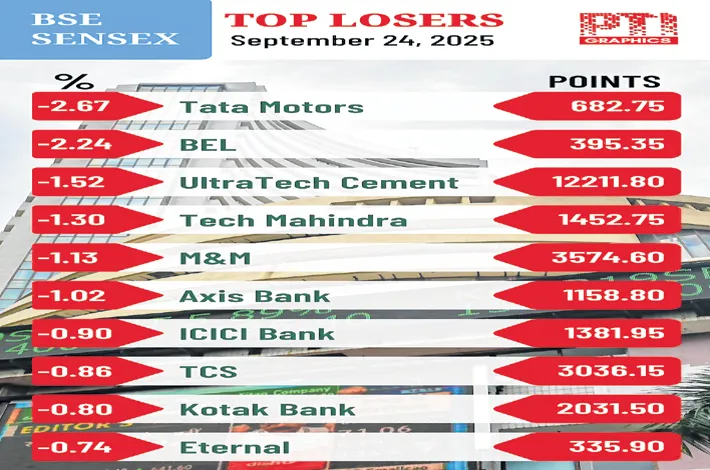

Sentiment cautious; post-GST reform profit-booking begins

25-09-2025 12:00:00 AM

FPJ News Service mumbai

Key indices declined for the fourth consecutive day on Wednesday as foreign fund outflows continued to dampen market sentiments.The 30-share BSE Sensex fell 386.47 points to close at 81,715.63. During the day, it lost 494.26 points at 81,607.84. The 50-share NSE Nifty lost 112.60 points to 25,056.90.

“IT counters underperformed, pressured by H-1B fee escalation, while ongoing US trade frictions and softening global macros weighed on risk appetite, keeping market participants in a defensive posture. Our broader view remains positive, and we believe the current consolidation phase offers a buying opportunity within the ongoing uptrend,” Bajaj Broking said in its analysis.

“Now a concern in the market globally is the high asset prices. Prices of assets be it stocks, gold, silver, bitcoins are high. This concern was articulated by the Fed chief Jerome Powell on Tuesday in his speech at Rhode Island. Powell reiterated the risks to inflation and employment, too, signalling that the Fed policy, going forward, will be challenging,” said Dr VK Vijayakumar, chief investment strategist, Geojit Investments.

In India, Dr VKV said, even though the Nifty is around 4% down from the September 2024 peak, valuations continue to be higher than the long-term averages. But these valuations will become justifiable when the earnings growth picks up, hopefully in FY27. But the valuations in the smallcap segment continue to be elevated with potential for further correction. Investors should give emphasis to valuations and growth potential while investing on market declines.