Sustainability of rally depends on mkt fundamentals: Analysts

20-03-2025 12:00:00 AM

FPJ News Service mumbai

Equity markets settled on a positive note on Wednesday, taking the winning momentum to the third day running on heavy buying in select scrips. Blue-chip IT stocks, however, witnessed heavy selling ahead of the US Fed policy decision. The BSE 30-share Sensex climbed 147.79 points to settle at 75,449.05. The NSE Nifty rose 73.30 points or 0.32 per cent to 22,907.60.

“The big question is: will the market rally continue? The domestic macros favour continuation of the rally. If FIIs continue to buy, the rally can sustain, but it remains to be seen. The external factors continue to be negative and hugely uncertain, and April 2nd and reciprocal tariffs are not far away.

A significant feature of the last two days’ rally was led by fairly-valued, domestic-focused segments like leading financials. Beaten-down stocks in the mid and smallcap segments also have bounced back. There is more steam left in this segment, too, even though the valuations in the broader market continue to be high.

Investors can wait for better clarity to emerge on the sustainability of the ongoing trend. Domestic-focused themes continue to be safe bets,” Dr V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services told The Free Press Journal.

Investors' wealth surged Rs 13.82 lakh crore in three days of market rally after last week’s correction. The market capitalization of BSE-listed cos soared Rs 13,82,485.7 crore to Rs 4,05,00,918.63 crore. After almost a month, the market capitalisation of BSE-listed firms regained the Rs 400 lakh crore-mark.

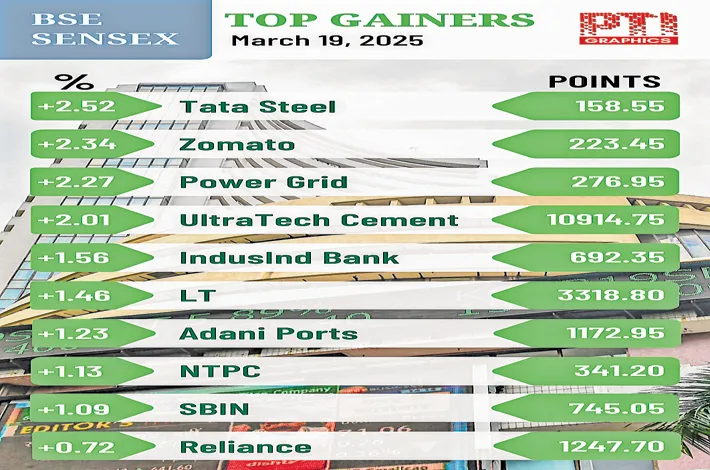

FIIs sold equities worth Rs 1,096.50 crore on Wednesday and domestic Institutional Investors bought equities worth Rs 2,140.76 crore. The recovery was broad-based as Tata Steel, Zomato, Power Grid, UltraTech Cement, IndusInd Bank, L&T, Adani Ports, NTPC, SBI and Reliance Industries performed well.