The New Wealth Playbook

09-06-2025 12:00:00 AM

Collecting, Escaping, and Investing Like a Modern Mogul Picture this

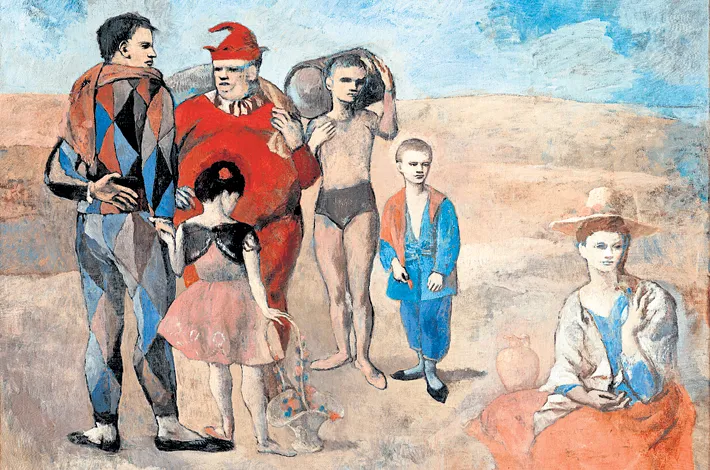

A tech billionaire unveils a rare Picasso at a gala on his private island, while his AI-powered investment portfolio quietly nets him $50 million overnight. For the rich and prosperous, wealth isn’t just about money—it’s about curating a life of exclusivity, freedom, and foresight. Today’s elite are redefining prosperity through three timeless pursuits: building legacies with rare collections, claiming private paradises, and harnessing artificial intelligence to multiply their fortunes. Here’s how these pillars of modern affluence intertwine to create a playbook for the discerning mogul.

The art of collecting has long been a hallmark of the wealthy, but it’s evolved into a strategic passion that blends pleasure with profit. Imagine owning a 1962 Ferrari 250 GTO, which fetched $48 million at auction in 2018, or a bottle of 1945 Romanée-Conti wine, valued at over $500,000. These aren’t just purchases—they’re investments in scarcity and stories. The thrill lies in the hunt: private auctions at Sotheby’s, hushed conversations with dealers, and the rush of outbidding rivals. For the prosperous, it’s about more than status—it’s about legacy. Fine art, for instance, has delivered a 10.6% annual return since 2000, according to Artprice, outpacing many traditional assets. Whether it’s a Basquiat canvas or a vintage Patek Philippe watch, collectors curate personal museums, preserved in climate-controlled vaults, to pass down through generations. It’s a game of patience and prestige, where the payoff is both cultural and financial.

Yet, what good is wealth without escape? Enter the private island, the ultimate retreat for those who can afford it. Since 2020, over 500 islands have changed hands globally, snapped up by billionaires like Larry Ellison, who owns Lanai in Hawaii. These aren’t just vacation homes—they’re bespoke kingdoms, offering seclusion and control in an increasingly crowded world. Picture landing by helicopter on a Caribbean atoll, greeted by infinity pools and solar-powered eco-villas. The process is as elite as the outcome: brokers like Private Islands Inc. guide buyers through deals ranging from $5 million to $100 million, factoring in yacht docks and local permits. The lifestyle is unparalleled—hosting intimate retreats for fellow moguls or crafting family memories away from prying eyes. As one broker put it, “It’s not just property; it’s sovereignty.” For the rich, islands redefine freedom, turning wealth into a tangible slice of paradise.

While collecting and escaping satisfy the soul, the mind of the modern mogul turns to multiplying wealth—and artificial intelligence is the sharpest tool in the shed. AI has revolutionized high-stakes investing, analyzing market trends, consumer shifts, and geopolitical risks faster than any human could. Take Renaissance Technologies’ Medallion Fund, which has averaged a staggering 66% annual return since the late 1980s, thanks to AI-driven strategies. For the affluent individual, platforms like Wealthfront offer robo-advisors that optimize portfolios, while family offices commission custom AI models for tax efficiency and risk management. A venture capitalist once told me, “AI spots the patterns; I make the calls”—a reminder that technology augments, rather than replaces, human instinct. The numbers speak for themselves: hedge funds using AI consistently outperform peers, and the technology’s reach is only growing. Yet, it’s not without caveats—data privacy and ethical questions linger. Still, for the prosperous, AI is less a gamble and more a necessity, ensuring they stay ahead in a world of accelerating change.

These three pursuits—collecting, island ownership, and AI investing—aren’t isolated indulgences; they’re a trifecta of modern wealth. A rare painting might hang in an island villa, bought with profits from an AI-predicted market surge. Together, they offer a blueprint for the elite: chase what’s exclusive, secure what’s private, and invest with precision. The joy of a curated collection lies in its permanence, a counterpoint to the fleeting chaos of markets. An island provides a sanctuary to enjoy those treasures, while AI ensures the funds keep flowing to sustain it all. For the rich, this isn’t just a lifestyle—it’s a legacy in motion.

So, where to begin? Start small—bid on a rare watch, tour a $5 million cay, or dip into an AI-powered fund. The tools are at your fingertips, and the rewards are as vast as your ambition. In a world where wealth is both a privilege and a playground, the modern mogul doesn’t just live well—they build empires of passion, privacy, and profit. What’s your next move?