Trump’s Damocles sword of tariffs hangs over markets

26-03-2025 12:00:00 AM

FPJ News Service mumbai

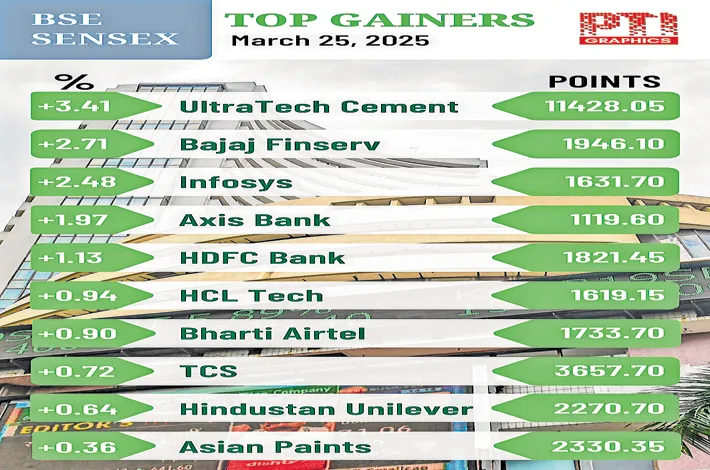

Markets extended the winning run to the seventh day on Tuesday on sustained FII buying and expectations of a rate cut and a mutually beneficial India-US trade deal.

“Even though the market momentum favours the bulls there is no fundamental support to take the market much higher from the present levels, particularly when President Trump’s Damocles sword of reciprocal tariff is hanging over the head of markets,” market men said.

The BSE-30 Sensex closed higher by 32.81 points at 78,017.19. During the day, the index jumped 757.31 points to 78,741.69 but squandered most of the gains in mid-session due to profit taking. The NSE Nifty gained 10.30 points to close at 23,668.65. Markets closed almost flat due to profit booking in heavyweights.

Reports were there in the market on Tuesday that India is open for further dialogues on cutting tariffs on US imports of $23 billion or more, and negotiations (at various levels are continuing), aimed at mitigating the negative impact of reciprocal tariffs to a manageable level.

“After a six-day recovery rally, the broader market witnessed some profit booking, particularly in small and mid-cap stocks, where premium valuations still exist. On the other hand, the IT sector posted gains, driven by positive global cues stemming from expectations of softer tariffs and a recent correction in valuations. In the near-term, investor sentiment is expected to be cautious as they await clarity on trade policy between US-India.

Meanwhile, attention is shifting towards the quarterly results, which is anticipated to shed light on the recovery in earnings growth. Favourable indicators, such as expected rate cuts and rupee movements, continue to support the market sentiment,” Vinod Nair, Head of Research, Geojit Investments, said.