AP records highest-ever January GST collections

02-02-2026 12:46:55 AM

Outpaces national growth

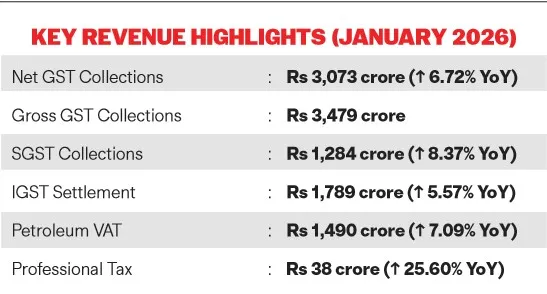

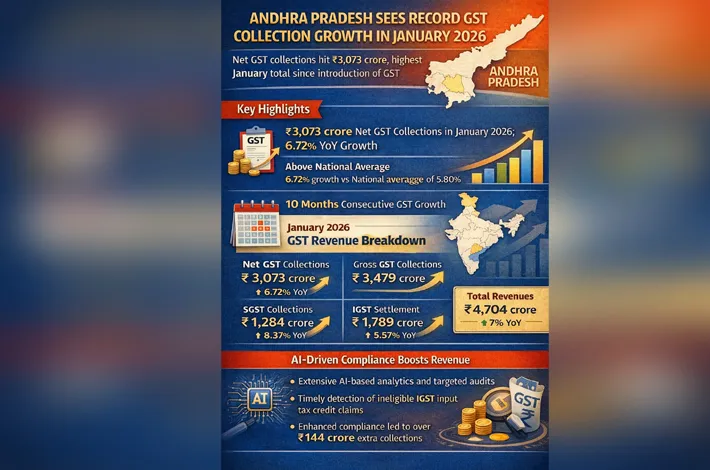

Andhra Pradesh has posted a robust 6.72% year-on-year growth in Net GST collections in January 2026, reaching Rs. 3,073 crore, the highest January collection since the introduction of GST in 2017, despite significant GST rate reductions and the rollout of GST 2.0 reforms.

This strong performance comes even as GST rates were reduced on key consumer essentials, consumer durables, pharmaceuticals, automobiles and cement, and GST was withdrawn on life and medical insurance. Compensation Cess was also removed on most products, except tobacco, effective September 22, 2025.

Above national average, among top southern states

Andhra Pradesh’s 6.72% growth exceeds the national average of 5.80% (excluding imports). Among southern states, Andhra Pradesh ranked second only to Karnataka, outperforming Kerala, Tamil Nadu and Telangana—underscoring the State’s stronger economic momentum and compliance framework.

Ten months of sustained growth

Net GST collections in Andhra Pradesh have consistently exceeded last year’s levels for ten consecutive months (April–January 2026), reflecting sustained growth in economic activity, consumption and tax compliance.

AI-driven compliance powers growth

The growth in revenue has been driven by enhanced compliance mechanisms, extensive use of AI-based data analytics, targeted audits, and timely identification of ineligible IGST input tax credit claims. These measures alone resulted in over Rs 144 crore in additional collections, while improved IGST settlements added significant revenue inflows to the State.

Total revenues touch Rs 4,704 crore

Total collections across all sectors in January 2026 stood at ₹4,704 crore, marking a 7% growth over January 2025. Cumulatively, total collections up to January 2026 rose to Rs 44,221 crore, registering a 4.79% increase over the previous year.

A stable and resilient fiscal trajectory

Despite a modest base and the absence of tax-rate driven windfalls, Andhra Pradesh has demonstrated steady, non-volatile growth, contrasting with sharp declines seen in some other states. The performance highlights the State’s resilient revenue systems, efficient tax administration, and expanding tax base.

The sustained upward trend signals a strong and stabilising fiscal trajectory, positioning Andhra Pradesh favourably at both the regional and national level as a leader in GST revenue mobilisation.