Economy on stable footing, likely to expand by 6.8-7.2 pc in FY27: Survey

30-01-2026 12:00:00 AM

Over the past decade, India has implemented a series of structural reforms, including the Goods and Services Tax (GST), insolvency and bankruptcy code, and digital infrastructure enhancements like UPI and Aadhaar

India's Economic Survey 2025-26, tabled in Parliament by Finance Minister Nirmala Sitharaman, paints a picture of resilience and cautious optimism for the world's fastest-growing major economy. Prepared under the guidance of Chief Economic Advisor V Anantha Nageswaran, the document projects a GDP growth rate of 6.8-7.2 percent for the upcoming fiscal year. This forecast, while slightly tempered from the current year's estimated 7.4 percent, underscores the cumulative benefits of recent reforms that have placed the economy on a stable footing.

In an era marked by geopolitical tensions, fluctuating commodity prices, and shifting global trade dynamics, the Survey emphasizes India's relative strength, driven by robust macroeconomic fundamentals. It argues that these reforms are not just short-term fixes but are elevating the nation's medium-term growth potential to around 7 percent, a level that could propel India toward its vision of a "Viksit Bharat" – a developed India by 2047.The projection for GDP growth reflects a pragmatic assessment of both domestic achievements and external headwinds.

Over the past decade, India has implemented a series of structural reforms, including the Goods and Services Tax (GST), insolvency and bankruptcy code, and digital infrastructure enhancements like UPI and Aadhaar. These have streamlined business operations, improved tax compliance, and fostered a more inclusive economic ecosystem. The Survey highlights how these changes have cumulatively boosted productivity and efficiency across sectors. For instance, the easing of regulatory burdens has attracted foreign investment, while infrastructure spending has created multipliers in employment and consumption.

However, the slight downward revision from 7.4 percent acknowledges potential risks, such as slower global demand and domestic challenges like uneven monsoon impacts on agriculture. Despite this, the document asserts that India's growth trajectory remains superior to most peers, positioning it as a beacon of stability in a volatile world.One of the most discussed aspects of the Survey is the state of the Indian rupee, which has depreciated sharply in recent months. The document candidly states that the rupee's current valuation fails to mirror India's impressive economic fundamentals, describing it as "punching below its weight."

This undervaluation, while not ideal, offers some silver linings in the current global context. For example, a weaker rupee helps mitigate the adverse effects of higher American tariffs on Indian exports by making them more price-competitive in international markets. Additionally, with crude oil prices stabilizing, there is little immediate risk of imported inflation escalating due to costlier energy imports. Yet, the Survey warns that this depreciation could deter investors, who might hesitate to commit capital amid currency volatility. Investor reluctance, it notes, deserves closer scrutiny, as sustained foreign inflows are crucial for funding infrastructure and innovation-led growth.

Building on this, the Economic Survey advocates for a strong and stable currency as an essential pillar for India's long-term ambitions. Achieving global influence and the status of a developed nation requires a currency that inspires confidence, facilitating easier access to international capital and reducing borrowing costs. The rupee's woes are attributed largely to the drying up of foreign capital flows, exacerbated by global risk aversion and rising interest rates in advanced economies. In response, the document calls for policies that enhance currency stability, such as building forex reserves and diversifying funding sources.

This perspective aligns with India's broader strategy of economic self-reliance, or Atmanirbhar Bharat, which seeks to reduce vulnerability to external shocks. By fostering a resilient financial system, India can better navigate the uncertainties of global capital movements.Comparatively, the Survey positions India favorably against other nations, crediting its strong macroeconomic fundamentals for this edge. While many countries grapple with high inflation, mounting debt, and sluggish recovery post-pandemic, India has maintained prudent fiscal management and controlled inflation.

Core inflation, excluding volatile food and fuel prices, has followed a subdued trajectory, signaling improvements in supply-side conditions. This includes better logistics, increased manufacturing capacity, and agricultural reforms that have enhanced food security. The document argues that these factors have created a virtuous cycle of investment and growth, insulating the economy from external pressures. Moreover, in an uncertain global environment reshaped by geopolitical realignments – such as tensions in the Middle East or US-China trade frictions – India must prioritize domestic drivers of growth.

This involves bolstering buffers like fiscal reserves and liquidity provisions to weather potential storms. A key recommendation from the Survey is the need for deeper institutional capacity that accounts for the geopolitical implications of India's rise. As the country ascends the global stage, its policies must integrate strategic considerations, such as securing supply chains for critical minerals and technology. The global landscape is evolving rapidly, with realignments influencing investment flows, trade routes, and growth prospects.

For India, this means adapting to disruptions in global value chains while capitalizing on opportunities like near-shoring from China. The Survey urges a focus on domestic growth engines, including consumption-led expansion and export diversification, to mitigate risks. By emphasizing liquidity and buffers, policymakers can ensure the economy remains agile, ready to respond to shocks like commodity price spikes or financial market turbulence.On the fiscal front, the pre-Budget document reaffirms the government's commitment to consolidation.

It projects that the central government is on track to meet its fiscal deficit target of 4.4 percent of GDP for 2025-26. As of November 2025, the deficit stood at 62.3 percent of the Budget Estimates, a figure that reflects disciplined spending amid revenue buoyancy from GST and direct taxes. The Survey praises this trajectory, noting that markets have rewarded India's fiscal prudence with lower sovereign bond yields. The spread over US Treasury bonds has narrowed by more than half, reducing borrowing costs and freeing up resources for productive investments.

This acknowledgment from financial markets underscores the credibility of India's fiscal framework, which has been a cornerstone of its post-pandemic recovery.Trade performance receives significant attention in the Survey, particularly in light of external challenges. Despite heightened US tariffs, India's merchandise exports grew by 2.4 percent from April to December 2025, while services exports surged by 6.5 percent. Merchandise imports rose by 5.9 percent during the same period, reflecting robust domestic demand.

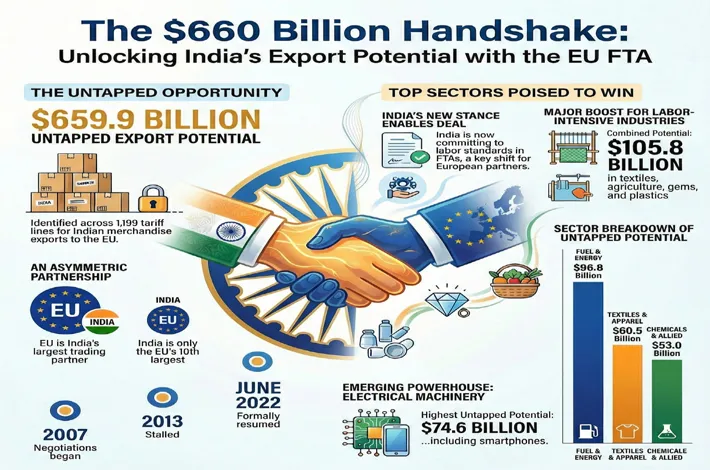

The document attributes this resilience to reforms like GST rationalization, which have transformed global uncertainties into opportunities. The next fiscal year, it predicts, will be one of adjustment as the economy adapts to these changes, potentially unlocking new export avenues. In the context of India's expanding free trade agreements (FTAs), the Survey stresses the importance of competitive production. Realizing the full potential of these pacts requires enhancing manufacturing efficiency, reducing logistics costs, and investing in skill development.

Particularly noteworthy is the discussion on the FTA with Europe, which the Survey views as a game-changer for India's manufacturing sector. This agreement is expected to bolster export resilience, attract technology transfers, and build strategic capacities in areas like renewable energy and electronics. By integrating into European supply chains, India can diversify away from over-reliance on certain markets, mitigating risks from protectionist policies elsewhere. The document also highlights the role of remittances, which have consistently outpaced gross FDI inflows in most years.

These inflows have kept the current account deficit moderate at 0.8 percent of GDP in the first half of FY26, providing a stable external funding source. This stability is vital for maintaining balance of payments equilibrium amid volatile capital flows.The Economic Survey strikes a balanced tone on the overall outlook, declaring no room for pessimism but advocating caution in the face of global uncertainties. It posits that potential eruptions of multiple global crises – from climate events to geopolitical conflicts – could present India with opportunities to shape the international order.

As a rising power, India can leverage its demographic dividend, digital prowess, and diplomatic influence to advocate for equitable global governance. This proactive stance aligns with Prime Minister Narendra Modi's vision of India as a "Vishwa Guru" or global leader, contributing to solutions in areas like sustainable development and technology standards.A dedicated chapter on artificial intelligence (AI) adds a forward-looking dimension to the Survey. It warns of potential corrections in asset valuations if the AI boom fails to deliver expected productivity gains.

The hype surrounding AI has driven market exuberance, but without tangible economic benefits, such as widespread automation efficiencies, valuations could adjust downward. For India, which is rapidly adopting AI in sectors like healthcare and agriculture, this underscores the need for balanced investment. Policymakers should focus on ethical AI frameworks, skill upgradation, and data sovereignty to harness its potential while mitigating risks like job displacement. The Survey also spotlights India's burgeoning aviation sector as a symbol of its growth story.

Described as on a sustained trajectory, the industry benefits from supportive policies, surging demand, and infrastructure upgrades like new airports under the UDAN scheme. India has become the world's third-largest domestic aviation market, yet current passenger volumes tap only a fraction of the country's potential. With a growing middle class and tourism rebound, the sector could drive job creation and connectivity. However, challenges like fuel costs and regulatory harmonization must be addressed to sustain this momentum.

Finally, the document pitches for reforms in the gig economy, recognizing its role in India's flexible labor market. Gig workers, powering platforms like ride-hailing and food delivery, face issues such as income instability and lack of social security. The Survey calls for policies that reshape work terms, including minimum wage guarantees, health insurance, and skill training. This would not only protect workers but also enhance productivity in this expanding segment, contributing to inclusive growth.

In conclusion, the Economic Survey 2025-26 encapsulates India's journey toward economic maturity. With projected growth of 6.8-7.2 percent, strong fundamentals, and strategic reforms, the nation is well-positioned to thrive. Yet, the emphasis on caution, institutional strengthening, and global engagement reminds us that success demands vigilance. As India navigates an unpredictable world, this document serves as a roadmap, blending optimism with pragmatism to realize the dream of a prosperous, influential Viksit Bharat.

Telangana emerges as India’s engine for high-tech growth and inclusive innovation

Telangana in Economic Survey 2025-26

■ Leading India’s Services Boom

■ WE-HUB is a National Model for Women’s Entrepreneurship

■ Hyderabad is the Pulse of Urban Expansion

■ State sets a benchmark for Digital Governance

The Economic Survey 2025-26, tabled in Parliament by Finance Minister Nirmala Sitaraman on Thursday, spotlights Telangana as a pivotal force in India’s transition toward a high-value, digitally integrated economy. The Survey positions the state not merely as a participant but as a national blueprint for marrying modern service-led growth with robust social innovation.

The Survey identifies Telangana as a cornerstone of India’s modern economic structure. Citing data from NITI Aayog, it notes that Telangana, alongside Karnataka, Maharashtra, and Tamil Nadu, contributes to nearly 40 per cent of India’s total services output. Significantly, Telangana’s growth is distinguished by its quality: unlike regions driven by traditional sectors, the state’s output is anchored in high-productivity "modern services"—specifically Information Technology (IT/ITeS), finance, and professional services. This knowledge-intensive focus has solidified Telangana’s status as a primary contributor to India’s record-breaking services GVA in FY26.

In a significant endorsement of state-led social innovation, the Survey highlights WE-HUB as a pioneering Public-Private Partnership (PPP) model. Featured alongside other impactful initiatives like Kerala’s Kudumbashree, WE-HUB is lauded for its strategic role in connecting women entrepreneurs with formal credit, global investors, and start-up ecosystems. The document cites the initiative as a prime example of how targeted state interventions can accelerate women’s entry into higher-value, growth-oriented enterprises, moving beyond subsistence-level business.

Hyderabad features prominently in the Survey’s urban analysis. Using satellite-based Night-Time Lights (NTL) data to track economic intensity, the Survey points to Hyderabad as a case study in rapid urban densification. The data reveals a dual-growth trajectory: sustained economic deepening in the city core coupled with aggressive expansion into peri-urban regions. Furthermore, Hyderabad is categorized among India’s top eight major cities critical for monitoring national trends in affordable housing supply.

The Survey commends Telangana’s leadership in utilizing technology for transparent governance. It notes that Telangana is among the select few states to have fully operationalized the GPS-based Vehicle Location Tracking System (VLTS) for foodgrain transport. This real-time monitoring initiative is cited as a vital step in curbing leakages and ensuring the integrity of the Public Distribution System (PDS).

From fostering high-tech exports to creating institutional support for women entrepreneurs, the Economic Survey 2025-26 projects Telangana as a state that successfully balances aggressive economic modernization with inclusive governance mechanisms.