FPI investment threshold for granular disclosures doubled

25-03-2025 12:00:00 AM

FPJ News Service mumbai

SEBI’s board on Monday approved a proposal to double the investment threshold for granular disclosures by foreign portfolio investors (FPIs) to Rs 50,000 crore. The move is aimed at addressing the changing market dynamics without altering the concentration criteria, which remain unchanged.

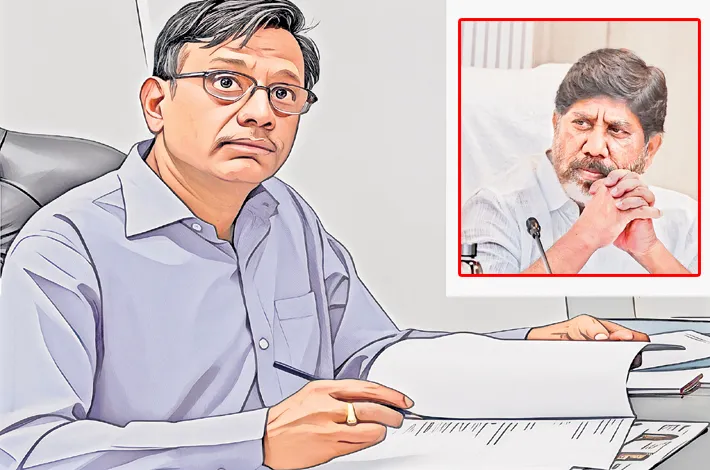

This was the first board meeting presided over by the new Chairman Tuhin Kanta Pandey. At present, certain FPIs with equity assets under management exceeding Rs 25,000 crore are required to provide granular details of all their investors or stakeholders on a look-through basis.

“Cash equity markets’ trading volumes have more than doubled between FY 2022-23 and the current FY 2024-25. In light of this, the board approved a proposal to increase the applicable threshold from the present Rs 25,000 crore to Rs 50,000 crore,” SEBI Chairman Tuhin Kanta Pandey told mediapersons.

FPIs holding more than Rs 50,000 crore in equity AUM in the Indian markets will now be required to make additional disclosures. In August 2023, SEBI had directed FPIs, who were holding over 50 per cent of their equity AUM in a single corporate group or with an overall holding in Indian equity markets of more than Rs 25,000 crore, to disclose granular details of all entities holding any ownership, economic interest, or exercising control in the FPI.

High-level panel to review conflict of interest for SEBI board members

The market has decided to set up a high-level committee to undertake a comprehensive review of conflict of interest, disclosures pertaining to property, investments and liabilities of members and officials on the board. The high-level committee, which is expected to submit its recommendation within three months from the date of the constitution, will be placed before the board of consideration.

IAs, RAs allowed to charge advance fees for up to 1 yr

The regulator has decided to allow investment advisers and research analysts to charge advance fees for up to one year. Under the existing rules, investment advisers (IAs) can charge fees in advance for up to two quarters if agreed upon by the client, while for research analysts (RAs) it was only for a quarter.

CRA to scrutinise claims of high returns by investment service providers

SEBI said that risk-return metrics of services offered by investment advisers, research analysts, and algo trading providers will be scrutinised by a credit rating agency, a move aimed at checking claims of high returns. Under the new norms, the credit rating agency (CRA) will act as 'Past Risk and Return Verification Agency' with a recognized stock exchange serving as ‘Past Risk and Return Verification Agency’ data centre.