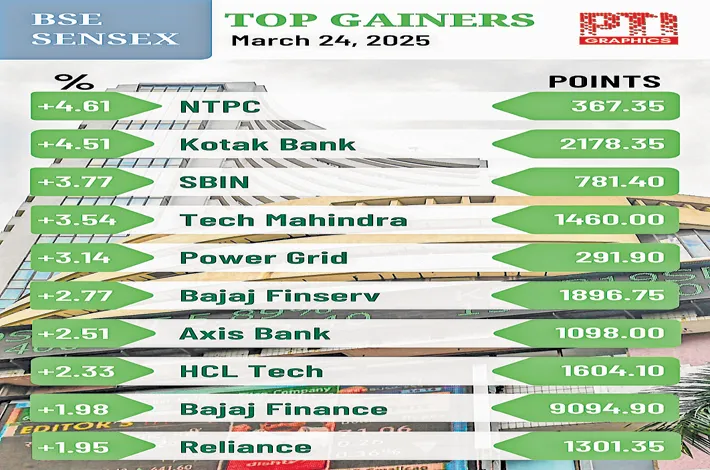

Sensex climbs 1,078 pts, FIIs take winning run to 6th day

25-03-2025 12:00:00 AM

mkts | Better macros, fair valuations trigger spikes in prices

Investors' wealth swells by `27.10 lakh crore as markets surge for 6th straight day

FPJ News Service mumbai

Improved macroeconomic fundamentals and fair valuations turned foreign investors from sellers to buyers, triggering massive short-covering, leading to sharp spikes in prices for the sixth day in a row on Monday. The BSE-30 Sensex climbed 1,078.87 points to close at 77,984.38. The NSE Nifty surged by 307.95 points to 23,658.35. The Sensex has jumped 4,155.47 points in six days since March 17.

Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Investment Services, said, “The uncanny ability of the market to surprise was evident last week when the Nifty surged by 4.6% in a week. The fact that this happened when globally markets were jittery on fears of Trump’s reciprocal tariffs kicking in from April 2nd is important.

“Improving macros of the Indian economy and fair valuations have turned FIIs from sellers to buyers. More importantly, this has triggered massive short covering leading to sharp spikes in prices.

“Even though the undertone of the market is bullish, investors have to be careful. April 2nd-the reciprocal tariffs day-is looming large and the uncertainty surrounding that is huge. Investors can wait for clarity to emerge on reciprocal tariffs before taking a call on further investment,” he added.

“The domestic market experienced a robust rally, spurred by value buying as valuations returned to long-term averages and early indications of earnings growth recovery emerged. Increased government spending and expected monetary easing are anticipated to boost optimism in rate-sensitive sectors such as banking, NBFCs, auto, consumer durables, and real estate, leading to potential outperformance. The sustainability of this trend will depend on upcoming PMI data, Q4 earnings results, and developments related to reciprocal US tariffs,” Vinod Nair, Head of Research, Geojit Investments, said.

Appreciation of the rupee has also boosted the market sentiment. Rising for the seventh straight session, the rupee has appreciated by over 30 paise at 85.67 against the dollar on Monday, wiping off all its losses in 2025, supported by the uptrend in equity markets and fresh flow of foreign funds.

Jateen Trivedi, VP Research Analyst, Commodity and Currency, LKP Securities, said, “Rupee traded positive, driven by strong FII buying over the last few days, which has reversed the fund flow impact on the rupee. If the dollar remains below 104$ and FII inflows continue, the rupee could inch towards the 85.00 zone this week. The next resistance levels are at 85.10-85.25, while support is seen at 85.85-86.00.”