Markets cautious amid rising India-Pak tensions along LoC

03-05-2025 12:00:00 AM

FPJ News Service mumbai

Despite heightened expectations surrounding a potential bilateral trade agreement between the US and India, market gains were trimmed on Friday, with key indices remaining largely flat due to escalating India-Pakistan tensions along the LoC.

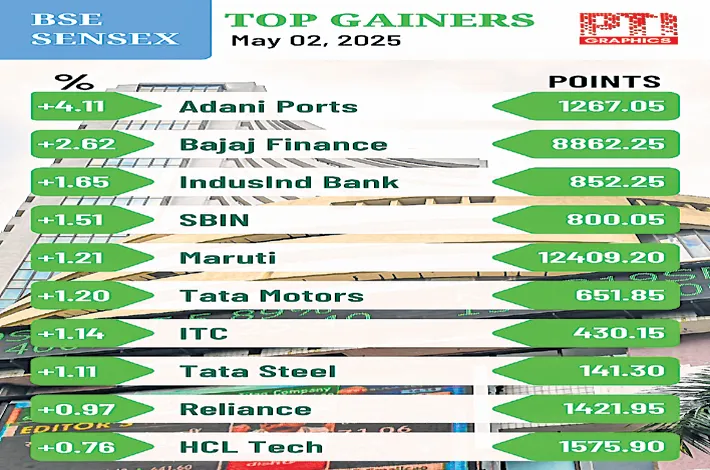

After a sharp rally in intra-day trade the 30-share BSE Senses lost most of the gains and closed 259.75 points higher at 80,501.99. The NSE Nifty closed 12.50 points higher at 24,346.70. FIIs and DIIs bought equities worth Rs 2,769.81 crore and Rs 3,290.49 crore, respectively.

“Broader markets experienced profit-booking after a strong rally from April lows, although sustained FII inflows helped markets end on a positive note. The recent rally triggered profit booking and rotation across sectors from broad indices to IT stocks. Muted Q4 results also are not providing support to maintain the last month's optimism. Nevertheless, renewed momentum in US-China trade negotiations and a weakening dollar are seen as positive drivers for EMs like India in the medium-term,” said Vinod Nair, Head of Research, Geojit Investments.

“FII buying has been driven by weakness in the dollar and declining growth prospects in the US. Other macros like declining interest rates in India, decline in the crude price and green shoots of pickup in demand are positives for the market. The high probability of India among the five ‘allies’ of the US entering into early trade deals with the US is a positive factor.

However, at the current juncture of high valuations (Nifty trading at above 20 times estimated FY26 earnings) and high India-Pak tensions, the near-term risk-reward is not in favour of high reward. Therefore, investors can play it safe by increasing the cash component in the portfolio even while remaining invested,” said Dr VK Vijayakumar, Chief Investment Strategist at Geojit Investments.