Markets cautious as US-China trade tensions escalate

14-10-2025 12:00:00 AM

The domestic markets opened the week on a cautious note on Monday as the ongoing US government shutdown and escalating US-China trade tensions triggered “risk-off sentiment” across Asia.

The 30-share BSE Sensex dropped 173.77 points to close at 82,327.05, snapping its two-day rally. After a gap-down opening, it tanked 457.68 points to a low of 82,043.14. However, resilience in banking and financial majors helped limit the downside in the second half. The 50-share NSE Nifty fell 58 points to settle at 25,227.35.

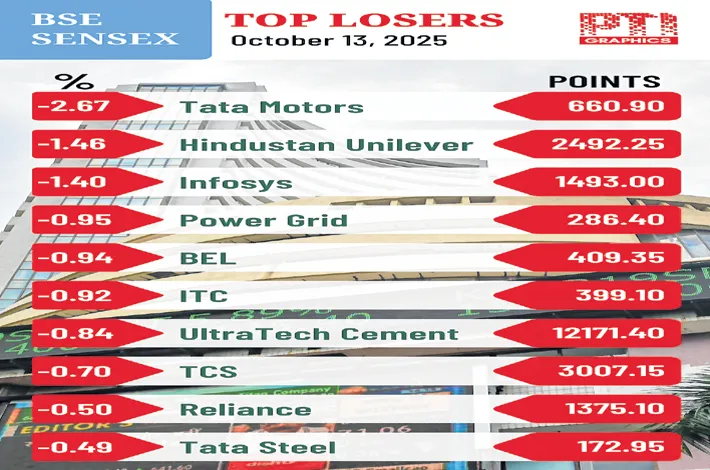

Tata Motors lost 2.67% ahead of the record date for determining shareholders’ eligibility for receiving shares in the demerged commercial vehicle business. Infosys, Hindustan Unilever, Power Grid, Bharat Electronics, ITC, UltraTech Cement and TCS were also among the losers.

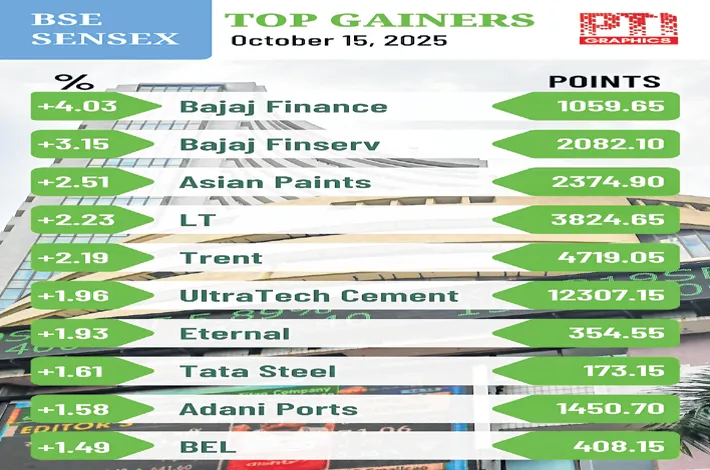

Bajaj Finance, Bajaj Finserv, Adani Ports, and Axis Bank were among the top gainers.

“Profit booking in consumption and discretionary sectors after recent rallies indicated a tactical shift in investor-positioning. Mixed Q2 earnings further weighed on sentiment, with IT stocks underperforming, while financials attracted selective buying following regulatory easing. Mid- and small-cap stocks maintained a positive undertone. Although a marginal recovery in the Rupee and softening inflation helped cushion losses, overall sentiment remained guarded, keeping markets under a slight negative bias,” said Vinod Nair, head of research at Geojit Investments.

According to Bajaj Broking Research, subdued global sentiment and profit-booking at elevated valuations weighed on investor confidence. Market participants remained on edge amid resurfacing US-China trade tensions, despite tentative signs of stability in overseas markets. A partial recovery in global cues was seen after Trump adopted a more conciliatory tone, indicating openness to negotiations.