Pivotals inch higher ahead of Diwali rally

16-10-2025 12:00:00 AM

FPJ News Service mumbai

The Indian equities inched higher on Wednesday after two days of selling amid festival season, Fed Chair Powell’s confident comments on future monetary policy actions and renewed FII support.

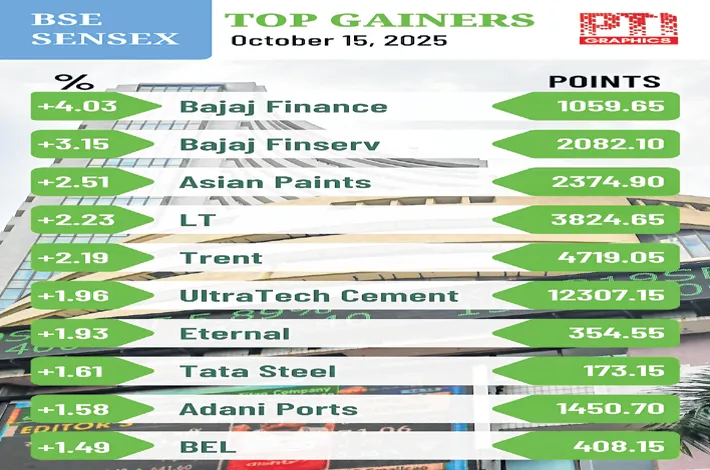

Powell’s Tuesday speech that the Fed would set policy based on the evolution of the economic outlook and the balance of risks, rather than following a predetermined path, and “there is no risk-free path for policy as we navigate the tension between our employment and inflation goals”. Reflecting the uptrend, the 30-share BSE Sensex climbed 575.45 points to close at 82,605.43, and the Nifty gained 178.05 points at 25,323.55.

“The dovish comment by the Fed chair on rates and considering an end to its quantitative tightening sparked the global market sentiment. The US 10-year yield declined while the rupee gained, indicating a momentum shift in FIIs to emerging markets like India, which may navigate the domestic market trajectory in the short to medium term. Realty outperformed due to an ease in the interest rate cycle and attractive valuation, while positive global cues supported the IT and Metal indices,” opined Vinod Nair, head of research at Geojit Investments.

“The drift in the market for the last two sessions (Monday and Tuesday) can be attributed to lack of positive triggers and renewed selling by FIIs, posing short-term challenges to the market. It is important to note that the biggest challenge is poor growth in earnings. The Q2 results are unlikely to change the sentiments.

However, post- September the story has changed a bit, as automobiles and white goods have started witnessing brisk sales, and in the low-interest regime, with more rate cuts to come, this demand is expected to sustain. These positives will be reflected not in the ongoing Q2 results season but in the Q3 results. The market will soon start discounting that, and that is when a healthy market rally will begin and sustain,” said a veteran investment strategist Dr. VK Vijayakumar.