Mkts consolidate; FII fund outflows, Ahd plane crash dampen sentiment

13-06-2025 12:00:00 AM

Consolidation in Indian markets is apparently evolving into a broad-based trend as it extended to large-cap stocks on Thursday.

Fresh FII fund outflows, renewed tariff worries, rising Israel-Iran tensions, and the London-bound Air India plane crash in Ahmedabad dampened the market sentiment.

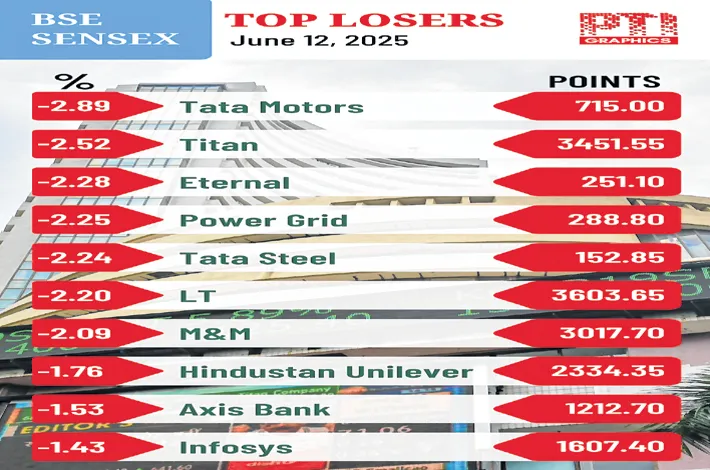

FIIs offloaded equities worth Rs 3,831.42 crore, and domestic institutions bought equities worth Rs 9,393.85 crore. The 30-share BSE Sensex lost 823.16 points to settle at 81,691.98. During the day, it lost 992 points to 81,523.16. The broader NSE Nifty fell 253.20 points to 24,888.20. Tata Motors, Titan, Eternal, Power Grid, Tata Steel, L&T, M&M and Hindustan Unilever were among the top losers. Bajaj Finserv, Asian Paints and Tech Mahindra were the top gainers.

Shares of IndiGo and SpiceJet declined as the market sentiment toward airline stocks weakened amid growing concerns around flight safety. Shares of aircraft manufacturer Boeing plunged nearly 8% in global markets in pre-market trade on Thursday.

“Valuation concerns and rising oil prices—driven by Middle East tensions—are fuelling risk aversion among investors. IT, metals, and auto sectors have mostly underperformed. Adding to the uncertainty, the US is considering unilateral tariff hikes on several key trading partners, with a decision expected within the next one to two weeks, ahead of an early July deadline. Meanwhile, gold is witnessing a fresh leg of safe-haven buying, amid escalating geopolitical and economic risks,” pointed out Vinod Nair, head of research, Geojit Investments. “The tariff crisis is not yet over. China has not yet officially confirmed the reports of an agreement with the US. Trump has declared that he will be sending letters to trade partners in the next two weeks setting universal tariffs. Market participants will be waiting and watching for clarity on this,” said Dr VK Vijayakumar, chief investment strategist at Geojit Investments.

Investors' wealth eroded by Rs 5.98 lakh crore to nearly Rs $5.26 trillion.