Mkts fall amid escalating India-Pakistan tensions

09-05-2025 12:00:00 AM

Global market remains stable and positive, buoyed by expectations of an imminent US trade deal with the UK

FPJ News Service mumbai

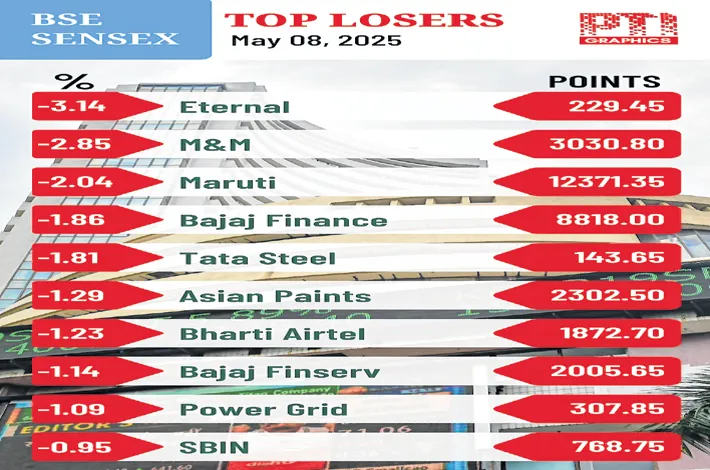

Concerns about escalating tensions between India and Pakistan and weak investor sentiment dragged down Indian markets on Thursday. The 30-share Sensex lost 411.97 points to settle at 80,334.81. The NSE Nifty closed lower by 140.60 points to 24,273.80. Reflecting the downtrend, investors’ wealth eroded by Rs 5 lakh crore to Rs 4,18,50,596.04 crore. Eternal, Mahindra & Mahindra, Maruti, Bajaj Finance, Tata Steel, Bharti Airtel, Bajaj Finserv, Asian Paints, Power Grid and State Bank of India were among the top losers.

Kotak Mahindra Bank, Axis Bank, Titan, HCL Tech, Tata Motors, Infosys and Tata Consultancy Services were among the top gainers. “From the market perspective, it is important that the conflict should not escalate. An escalation, apart from other fallouts, will also impact India’s fiscal consolidation drive.

If the MPC is to continue with rate cuts, fiscal consolidation is important. The Fed chief Jerome Powell’s observation that “risks of higher unemployment and higher inflation have risen” and that “ we think we can be patient “ is a clear message that the Fed chief will not accommodate President Trump’s demand for rate cuts.

“The Fed’s action will be data dependent. The US has reached a trade deal with the UK, the first trade pact since President Trump paused reciprocal tariffs and began negotiating with countries to lower trade barriers. This is the beginning of trade deals between the US and other countries. Investors may wait and watch the developments on the India-Pak tensions,” Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments, said.

“The Indian equity market experienced profit booking by the end of the trading day due to escalating tensions between India and Pakistan, marked by increased cross-border exchanges. The FOMC policy meeting provided little reassurance, as the US Fed expressed concerns that aggressive US tariffs could fuel inflation and raise unemployment.

However, the global market remains stable and positive, buoyed by expectations of an imminent US trade deal with the UK and preliminary indications of trade talks with China. Historically, the domestic volatility is expected to neutralize as cross border issues de-escalates,” said Vinod Nair, Head of Research, Geojit Investments.

Trading was volatile due to selling in banking, FMCG and auto shares, triggered by escalating tensions between India and Pakistan. Indian forces foiled attempts by the Pakistani military to engage a number of military targets in Northern and Western India.