More Indian banks to merge?

31-10-2025 12:00:00 AM

As India’s economy surges toward a projected $40 trillion GDP by 2047, industry leaders at a recent discussion forum emphasized the critical need for larger banks to support the nation’s ambitious growth trajectory. The discussion, hosted by a reputed financial journal highlighted the necessity of bank consolidation to enhance scale, improve technological capabilities, and meet the financing demands of an increasingly globalized Indian corporate sector. The forum, featuring prominent banking executives underscored that India’s demand-driven economy fuelled by a young population and rising consumption, requires robust financial institutions capable of underwriting large-scale projects.

A senior executive remarked that as today many Indian companies are very large, for banks to contribute meaningfully their size too must increase, giving examples of how projects today often range from Rs 8,000 to Rs 15,000 crores compared to 1500 crores a decade ago. Larger banks with stronger balance sheets would be better positioned to underwrite such high-value initiatives in sectors like semiconductors and renewable energy, he opined. The discussion also spotlighted the global aspirations of Indian banks.

With only two Indian banks currently in the global top 100, experts advocated for at least two to three banks to rank among the top 20 by 2047. Another senior financial sector expert pointed out that China has seven banks in the top 20. “We’re not saying we should become China, but at least two in the top 20 should be our aspiration,” he remarked. As per him, achieving this would require not only domestic scale but also significant international operations, enabling Indian banks to support corporates expanding abroad.

Technology was a recurring theme; with panelists stressing that larger banks can better afford critical investments in cyber security, data analytics, and artificial intelligence. One executive noted that smaller banks struggle to upgrade technology due to limited resources, highlighting that larger banks benefit from economies of scale, with cost-to-income and cost-to-assets ratios dropping to as low as 1% globally, compared to India’s 1.5-2%.

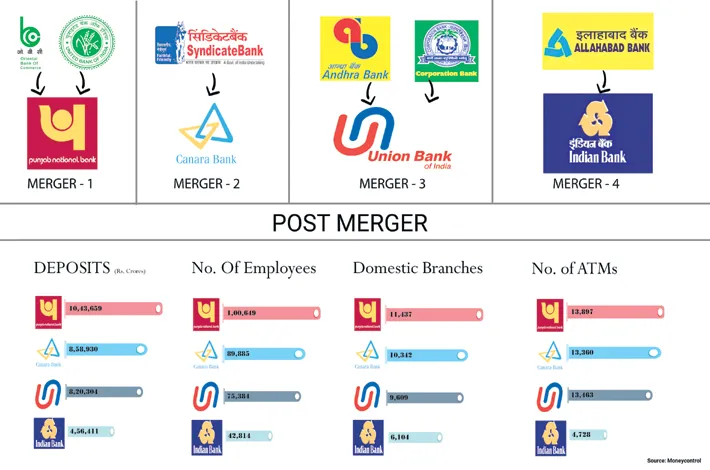

The forum also reflected on past consolidation efforts, such as the 2017 State Bank of India (SBI) merger with its associate banks and the 2019-2020 mergers involving banks like Bank of Baroda, Union Bank, and Punjab National Bank (PNB). While these mergers improved efficiency, capitalization, and profitability, challenges included integrating technology platforms, harmonizing human resources, and aligning diverse organizational cultures. A senior official of a private sector bank stated that even with the same core banking platform, different customizations create complexities, citing SBI’s experience with regionally focused banks like State Bank of Travancore and State Bank of Patiala.

Asset quality, a significant hurdle during earlier mergers due to high non-performing loans (NPLs) is no longer a major concern. An executive from a public sector bank noted that the asset quality of Indian banks is strong across public and private sectors, making the present as an opportune time for consolidation. The panel also highlighted the importance of cultural integration, with one speaker emphasizing that customers and culture were of utmost importance and if the work culture of the entities being merged isn’t harmonized, success would be at risk.

The discussion also touched on new opportunities such as the Reserve Bank of India’s (RBI) recent draft guidelines allowing banks to finance mergers and acquisitions (M&A), both domestically and abroad. With Indian banks holding Rs 12 lakh crore in tier-1 capital, up to Rs 1.2 lakh crore could be deployed for M&A financing, presenting a significant opportunity. A senior functionary of a public sector bank expressed confidence that Indian banks are well-placed to develop M&A advisory capabilities, leveraging their experience in underwriting complex projects. Additionally, the transition to a green economy was flagged as a critical driver for larger banks. With estimates suggesting a $10-23 trillion investment requirement by 2070, banks must scale up to finance this shift, which remains heavily reliant on bank funding rather than private capital.

As India progresses toward the “Viksit Bharat” vision by 2047 as put forth by Prime Minister Narendra Modi, the consensus is clear: larger, globally competitive banks are essential to fuel economic growth, support corporate ambitions, and navigate emerging challenges like de-dollarization and green financing. The path forward, however, will require careful planning to address technological, cultural, and operational complexities.