‘No one should depend on moneylenders’

24-01-2026 12:00:00 AM

- Andhra Pradesh CM N. Chandrababu Naidu announced rescheduling of loans worth nearly ₹50,000 crore out of ₹2 lakh crore of identified debt.

- The rescheduling has resulted in savings of ₹1,108 crore for the state.

- The announcement was made at the 233rd and 234th State Level Bankers Committee (SLBC) meetings at the Secretariat.

- Loans worth ₹49,000 crore have been rescheduled so far, following identification of eligible debt.

- Naidu urged banks to actively support MSMEs, citing their role in uplifting weaker sections involved in trade.

- He called for large-scale lending to SC, ST and BC communities to promote inclusive growth.

Emphasising that no citizen in Andhra Pradesh should be forced to depend on private moneylenders, Chief Minister N. Chandrababu Naidu on Friday urged banks to ensure easy access to institutional credit for all sections of society. He said people must be able to approach banks with confidence for every financial requirement, from agriculture to small businesses and personal needs.

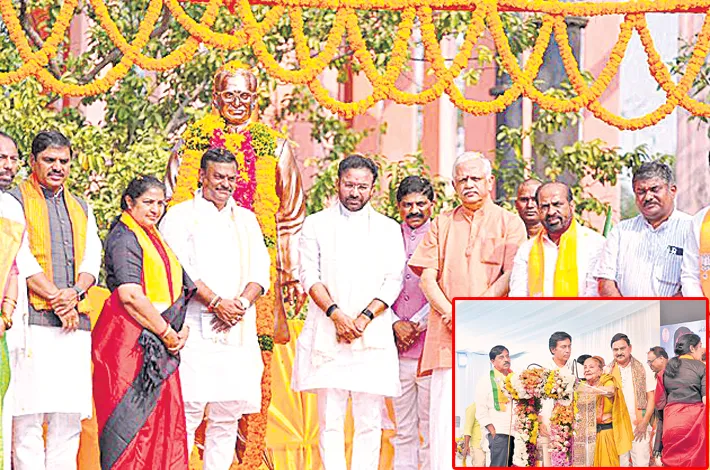

The Chief Minister made these remarks while chairing the 233rd and 234th State Level Bankers’ Committee (SLBC) meetings at the State Secretariat. The meetings focused on the state’s financial progress, implementation of annual credit plans, sector-wise loan disbursement, and the role of banks in supporting Andhra Pradesh’s development agenda. Senior officials and banking representatives reviewed key indicators related to agriculture, MSMEs, self-help groups, and priority sector lending.

Chief Minister Chandrababu Naidu conducted an in-depth review of agricultural credit delivery, financial inclusion, and bank outreach in rural areas. He stressed that no citizen in the state should be forced to depend on private moneylenders for loans. “Whether for agriculture or personal needs, people must have the confidence to approach banks. Bankers should work proactively to make institutional credit accessible to all,” he said.

During the deliberations, officials informed the Chief Minister that banks had so far extended loans worth ₹2.96 lakh crore to agriculture and allied sectors under the Annual Credit Plan. Of this, tenant farmers received loans amounting to ₹1,490 crore. The MSME sector, a major employment generator in the state, was provided financial assistance of ₹95,714 crore, reflecting steady credit flow to small and medium enterprises.

A major focus of the meeting was the government’s vision to develop Amaravati as a financial hub. The Chief Minister held detailed discussions with bankers on establishing a Central Business District (CBD) in the capital city. He urged banks and financial institutions to set up offices in Amaravati and support its transformation into a centre for banking, investment, and corporate activity. He noted that foundation stones had already been laid for offices of 15 banks and called for faster completion of construction works.

The Chief Minister further emphasized inclusive growth through enhanced lending to Scheduled Castes, Scheduled Tribes, and Backward Classes. “Only when disadvantaged sections receive adequate financial support will they progress across sectors,” he stated, adding that while governments were doing their part through policy measures, active cooperation from banks was essential to bridge socio-economic disparities.

Issues related to AP TIDCO housing loans were also discussed. Chandrababu Naidu said beneficiaries were facing difficulties due to unfulfilled assurances by the previous government, leading to banks hesitating to extend housing loans. He also sought rationalisation of charges levied on DWCRA group bank accounts, noting that nearly 15 types of fees were burdening women self-help groups.

Addressing concerns related to land records, the Chief Minister said the government was undertaking comprehensive reforms to ensure transparency and security. QR-code-enabled pattadar passbooks were being issued, and he suggested banks consider introducing QR-code-based systems for banking documentation as well.

The meeting was attended by Ministers Payyavula Keshav and Kondapalli Srinivas, Chief Secretary K. Vijayanand, the Managing Director of Union Bank of India, the RBI Regional Director, NABARD General Manager, senior officials from various banks, and directors of the National SC and ST Commissions.