RBI policy, festival-season tailwinds boost mkt sentiment

04-10-2025 12:00:00 AM

FPJ News Servicemumbai

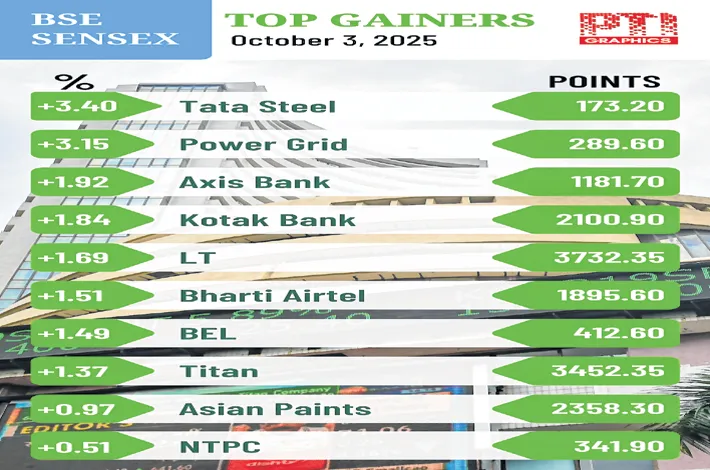

After a period of rangebound trading, the market closed on a positive note on Friday, supported by gains in metal and consumer durables stocks. Reflecting the positive market breadth, the 30-share BSE Sensex gained 223.86 points to close at 81,207.17. The 50-share NSE Nifty settled 57.95 points higher at 24,894.25. Power Grid, Axis Bank, Kotak Mahindra Bank, L&T, Bharat Electronics and Bharti Airtel were among top gainers. The positive impact of the central bank’s bold initiatives to boost credit growth in the economy has the potential to sustain the momentum in the market, particularly in Bank Nifty. But this momentum is unlikely to sustain in the context of the sustained FII selling in the market.

“FIIs are likely to further accelerate selling since the market construct provides them the opportunity to sell aggressively. The huge short position in the market indicates that the bulls will be on the defensive. Aggressive DII buying can provide some support to the market particularly in largecap auto stocks, which have strong fundamental support now.

“The central bank initiatives to accelerate credit flow into the economy will be positive for banks. The stronger banks will gain not only from higher credit growth but also from lower premium for deposit insurance. The fairly valued largecap banks are attractive buys from a medium to long-term perspective. Auto stocks will continue to be resilient backed by positive news of large orders and sharp increase in sales,” Dr VK Vijayakumar, chief investment strategist at Geojit Investments, said.

Lloyds Metals jumps over 6%, Tata Steel 3%

Metal stocks were in the limelight on Friday, with Lloyds Metals surging over 6%. The BSE metal index edged higher by 1.85% to settle at 34,048.62. Lloyds Metals and Energy jumped 6.14%, Tata Steel climbed 3.4%, National Aluminium Company (3.10%), Jindal Stainless (2.87%), Hindustan Zinc (2.18%), Hindalco (1.85%), JSW Steel (1.58%), Vedanta (1.30%) and Jindal Steel (1.23%).