Telangana Teetering on bankruptcy?

24-11-2025 12:00:00 AM

Crisis Brewing

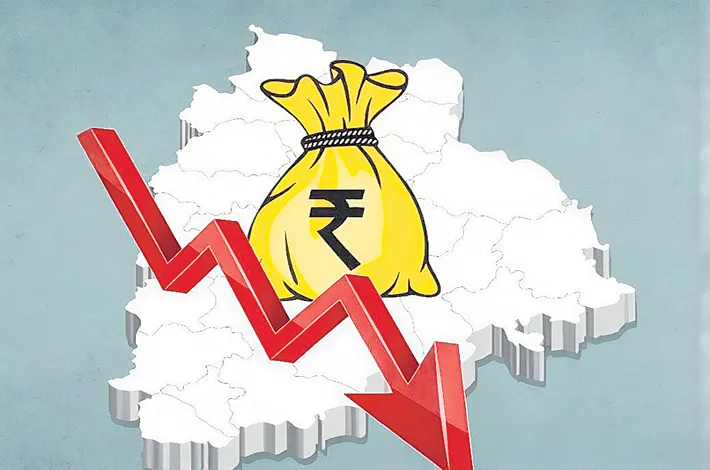

■ Off-budget liabilities: Rs 7.29 lakh crore.

■ State-serviced guarantees: Rs 1.27 lakh crore.

■ Self-serviced SPV loans: Rs 95,462 crore.

■ Non-guaranteed loans: Rs 59,414 crore.

■ Annual expenditure target: Rs 2.75 lakh crore.

■ Planned borrowings 2024-25: Rs 68,525 crore.

■ Pending bills in IFMIS: Rs 40,154 crore.

■ Loan waiver released: Rs 20,616 crore.

■ Kaleshwaram debt: Rs 60,869 crore.

■ Metro takeover estimate: Rs 15,000 crore.

The 2024-25 Vote-on-Account pegs total expenditure at Rs 2,75,891 crore (22.8% YoY rise), revenue receipts at Rs 2,05,602 crore (15.4% up), but fiscal deficit swells to Rs 53,228 crore (57.5% jump). Tax revenues buoy at Rs 1,38,228 crore, yet borrowings climb to Rs 68,525 crore, including Rs 59,625 crore market loans

MAHESH AVADHUTHA | Hyderabad

As Telangana's fiscal tightrope act intensifies, Chief Minister A. Revanth Reddy's stark warning of a state "on the brink of bankruptcy" has ignited fierce debate, pinning the blame on a ballooning debt legacy from the erstwhile Bharat Rashtra Samithi (BRS) regime.

With total liabilities exceeding Rs 8.11 lakh crore as of December 2023 – comprising Rs 6.71 lakh crore in loans under FRBM, corporations, and other heads, plus Rs 1.26 lakh crore in unpaid bills – the Congress government is grappling with a monthly revenue of just Rs 18,500 crore against Rs 13,000 crore in inescapable outflows for salaries, pensions, and debt servicing.

This leaves a meager Rs 5,500 crore for welfare flagships like Rythu Bharosa and Aarogyasri, fueling fears of insolvency. Yet, BRS Working President K.T. Rama Rao dismisses it as "Congress drama," claiming measured BRS-era borrowing of Rs 4 lakh crore over a decade built assets, not traps. Drawing from the Telangana Socio-Economic Outlook (SEO) 2024 – the state's annual blueprint of economic vitality, as etched on its blue-hued cover featuring Revanth Reddy and Deputy CM Mallu Bhatti Vikramarka amid vignettes of progress – official data reveals strained yet salvageable finances.

The report's preface underscores Telangana's upward economic scaling, driven by agriculture, manufacturing, IT, and pharmaceuticals, with GDP growth outpacing national averages, while its table of contents maps key sections: Economy (pages 13-56), including Macroeconomic Trends (15) and Public Finance (31); Agriculture & Allied Sectors (57); and Economic Infrastructure like Irrigation (180). Escalating deficits, welfare imperatives, and "White Elephant" projects like Kaleshwaram and Hyderabad Metro test resolve, but proactive reforms hint at recovery. This analysis unpacks the numbers: from debt spirals to irrigation pitfalls, probing if bankruptcy looms or resilience prevails.

Telangana's debt odyssey since 2014 statehood mirrors ambition unchecked. The "Outstanding Debt of Government of Telangana" dossier charts a surge: Rs 77,333 crore (14.4% of GSDP) in 2014-15 to a projected Rs 4,47,448 crore for 2024-25. Factoring off-budget burdens – Rs 1,27,208 crore in state-serviced SPV guarantees, Rs 95,462 crore in self-serviced ones, and Rs 59,414 crore in non-guaranteed loans – totals Rs 7,29,532 crore by end-2024-25. SEO 2024's Public Finance chapter (pages 31-58) echoes this, with the debt-to-GSDP ratio hitting 27.8% in 2023-24 (Budget Estimates), breaching the FRBM Act's 25% cap. Committed spends – salaries, pensions, interest – devoured 47.2% of Rs 60,168 crore revenue receipts in 2021-22, up from 51.7% prior year, squeezing capital outlays.

The 2024-25 Vote-on-Account pegs total expenditure at Rs 2,75,891 crore (22.8% YoY rise), revenue receipts at Rs 2,05,602 crore (15.4% up), but fiscal deficit swells to Rs 53,228 crore (57.5% jump). Tax revenues buoy at Rs 1,38,228 crore, yet borrowings climb to Rs 68,525 crore, including Rs 59,625 crore market loans. KTR retorts that BRS debt stood at Rs 3.50 lakh crore by March 2024, invested in growth engines like irrigation, and accuses Congress of Rs 1 lakh crore fresh borrowing in year one – "empty promises inflating liabilities," per RBI critiques. Revanth Reddy counters with appeals to the 16th Finance Commission for restructuring and 50% devolution hikes, shunning high-interest debt to shield citizens.

Monthly math underscores the squeeze: Rs 6,500 crore for 3.5 lakh employees' salaries/pensions, matched by debt repayments, starves Rs 5,500 crore for Rythu Bharosa (Rs 15,000/acre aid), Kalyana Lakshmi, and CMRF. SEO 2024 flags this "crowding out" of development. Pending bills, per IFMIS as of December 19, 2023, tally Rs 40,154 crore: Rs 15,686 crore at Pay & Accounts Office, Rs 9,062 crore in Public Deposits.

Revanth Reddy spotlights Rs 10,000 crore retiree dues, Rs 8,000 crore fee reimbursements, Rs 50,000 crore contractor payments, Rs 30,000 crore to power/Singareni, and Rs 5,000 crore liquor firms. Rythu Bandhu arrears cleared partially; the Rs 31,000 crore crop waiver (up to Rs 2 lakh) aided 70 lakh farmers with Rs 20,616 crore by August 2024, though Kharif 2023's Rs 7,625 crore lagged till December. Rythu Bharosa's Rabi 2025 rollout (Rs 7,500 crore to 55 lakh farmers) faces KTR's ire: "Rs 14,000 crore betrayal." Agriculture gets Rs 19,746 crore (7.2% budget), per SEO.

Irrigation embodies BRS overreach turned liability. SEO lauds Revanth Reddy's February 2024 Narayanpet-Kodangal scheme, watering 1 lakh drought acres, backed by Rs 28,024 crore (10.2% budget). But Rs 1 lakh crore Kaleshwaram – Revanth Reddy's "scam" under CBI probe since September 2025 – carries Rs 60,869 crore debt plus Rs 47,000 crore completion costs. REC loans (Rs 30,536 crore) teetered on NPA in June 2025; Rs 1,393 crore repayment averted it. Vigilance froze engineer assets in October. KTR hails it visionary, faulting delays for overruns. SPVs like TSWRIDCL and KIPCL dodged REC scrutiny via timely dues clearance. Mission Kakatiya revived tanks, aiding 11% agri growth (2021-22), but NPAs query viability.

Hyderabad Metro epitomizes "white elephant" woes. L&T's loss-making Phase-1 (69 km) prompted September 2025 handover decision for Rs 15,000 crore (Rs 2,100 crore equity + Rs 13,000 crore debt), valuing it at Rs 30,000-40,000 crore. "One km costs Rs 300-350 crore now," Revanth Reddy noted, funding via 200-acre land auctions. Phase-2 (73 km) progresses, per SEO. KTR alleges "threats" and airport line scrapping sabotaged it, shifting Rs 16,825 crore burdens but eyeing mobility upsides.

Bankruptcy? Revanth Reddy's May 2025 alarm – Rs 7 lakh crore debt squandering Rs 60,000 crore surplus – drew CAG flak: Rs 45,139 crore deficit by September, revenues at 43% FY26 targets. 2025-26 borrowings: Rs 69,639 crore; deficit 3% GSDP. No defaults yet; revenue surplus eyes 0.2%. BJP/BRS call it "hype"; Revanth Reddy pushes GST fixes, asset sales. FM Sitharaman flags post-formation "debt trap" despite aid. Six Guarantees claim Rs 53,196 crore.

Telangana's Rs 8+ lakh crore albatross, swelled by welfare and legacies, demands austerity, central succor, revenue ramps. Not insolvent, but the cliff calls for bipartisan data-driven navigation – as SEO 2024's preface implores: insights for prosperity.