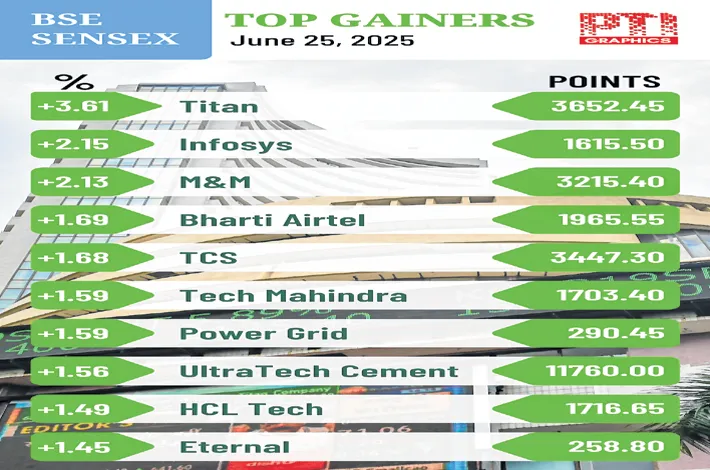

War tensions ease, sentiment upbeat

26-06-2025 12:00:00 AM

Despite the precise level of Trump’s tariffs and closure of FTA talks are still unclear, key indices settled at the highest levels of 2025

Palazhi Ashok Kumar mumbai

Markets witnessed a recovery on Wednesday as easing of geopolitical tensions in the Middle East, and a moderation in oil prices boosted the investment sentiment. The 30-share Sensex climbed 700.40 points to settle at 82,755.51.The wider gauge NSE Nifty closed 200.40 points higher at 25,244.75.

“Will US attack Iran again? It’s not a million dollar question. A fragile ceasefire brokered by the US between Iran and Israel appears to be holding, marking a tentative halt to a dangerous regional escalation that included airstrikes, retaliatory missile attacks and mounting civilian casualties.

“Investors at D-Street are cautious as many remain uncertain about a long-term ceasefire,” a high-networth individual investor told The Free Press Journal. "India's economy and its markets are resilient. However, uncertainty lurks underneath," market gurus warned investors.

Turbulence around the Mideast situation was complicating the geopolitical landscape. Key transmission channels included higher oil prices and a weaker macro-outlook. These, and an investor flight to quality, could undo benign credit conditions in Asia-Pacific. Despite significant tariff uncertainty, negative rating actions have been limited due to credit resilience of rated issuers and continuing financing access.

“While the precise level of tariffs is still unclear as trade negotiations churn on, it’s less likely that the highest threatened trade barriers will prevail. We believe tariffs are here to stay as the Trump administration focuses on bringing manufacturing jobs back to the US. Our base case incorporates 10% universal tariffs for all Asia-Pacific geographies (except China), 25% for some sectors (such as automobile, electronics, semiconductors, pharmaceutical, lumber etc.) and 50% for steel and aluminum,” S&P Global Ratings said on Wednesday.

“The domestic equity markets staged a recovery, supported by easing geopolitical tensions and a moderation in crude oil prices. While FIIs continue to withdraw capital, positive global cues are helping sustain domestic market momentum,” said Vinod Nair, head of research, Geojit Investments.