Why City of Pearls Losing Its Luster?

26-10-2025 12:00:00 AM

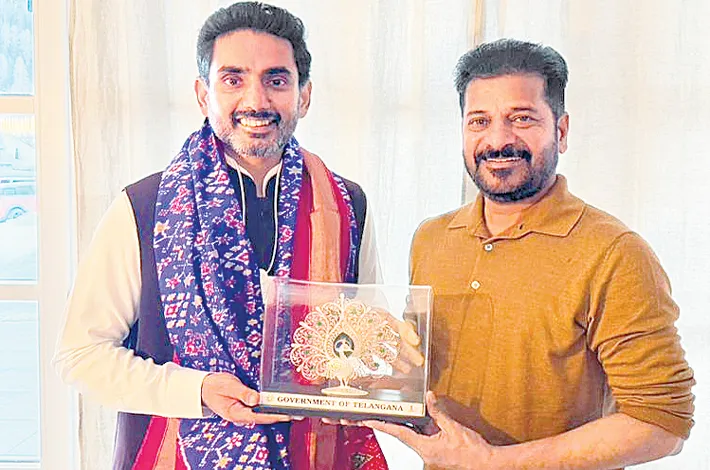

Is Hyderabad awaiting KTR?

Once the glittering jewel in India's southern crown, Hyderabad is fading into the shadows of its coastal rival, Visakhapatnam. While Andhra Pradesh (AP) reels in investment commitments topping ₹10 lakh crore – a staggering war chest fuelled by Chief Minister N Chandrababu Naidu and Minister Lokesh’s relentless global roadshows – Telangana's tech mecca limps along with a paltry ₹3 lakh crore in pledges. This isn't just a numbers game; it's a damning indictment of political inertia, bureaucratic quicksand, and a leadership vacuum that's turning investor dreams into nightmares. In the halcyon days under KT Rama Rao (KTR) as IT and Industries Minister, Hyderabad was the undisputed darling of global capital. Today, it's a cautionary tale of squandered potential.

Flashback to the Bharat Rashtra Samithi (BRS) era: From 2014 to 2023, KTR orchestrated a symphony of innovation that positioned Hyderabad as Asia's Silicon Valley. He lured giants like Google, Microsoft, and Amazon with single-window clearances, pharma parks, and a "zero bureaucracy" ethos. Investments surged over Rs 2.5 lakh crore in eight years alone, birthing 1.5 lakh jobs and branding the city as a hub for aerospace, life sciences, and EVs. KTR's jet-setting diplomacy – from Davos schmoozes to Washington roundtables – sealed deals worth billions, earning him the moniker "Young Tiger" and transforming Hyderabad into a peer of Singapore and Bangkok. Under his watch, Telangana topped ease-of-doing-business charts, with reforms slashing approvals from months to days.

Contrast that with the Congress regime since December 2023. Chief Minister A. Revanth Reddy's administration promised a "new dawn," but delivered a bureaucratic fog. Actual industrial approvals in 2025-26 are a measly Rs 6,008 crore for 1,125 units till September – a nosedive from KTR's glory days. While AP's State Investment Promotion Board greenlit Rs 1.14 lakh crore in October alone, including Google's Rs 87,000 crore data center blitz, Hyderabad's MoUs – totaling Rs 2.2 lakh crore over 18 months – gather dust amid red tape. Vizag, AP's gleaming port city, isn't just stealing headlines; it's poaching Hyderabad's thunder. Naidu's Vision 2050 has locked in Rs 4.47 lakh crore for 2024-25, reviving stalled projects worth Rs 24,590 crore and completing Rs 19,685 crore more. From green hydrogen hubs to semiconductor fabs, AP's pipeline is a testament to aggressive hustling – much like KTR's playbook, but supercharged by Naidu's BJP-backed Delhi access.

Hyderabad's advantages are a cheat sheet for success, yet they're rotting on the vine. Geographically, it's a nexus of India's heartland and coasts, with no seismic threats – unlike quake-prone Gujarat. Its talent pool? Over 8 lakh IT pros, churning out code for the world. Infrastructure gleams: Rajiv Gandhi International Airport boasts 100+ global connections, while ORR highways and metro rails hum efficiently. Law and order? Solid, with crime rates below national averages. Branding? Decades of Microsoft campuses and pharma giants like Dr. Reddy's have etched "Hyderabad" into investor lexicons. Land banks sprawl across 50,000 acres in Genome Valley and Fab City; the climate's balmy, sans monsoonal deluges. Why, then, is Vizag – with its humid haze and nascent infra – outpacing this paradise?

The rot starts at the top: political paralysis masquerading as governance. Investors whisper of a decision-making black hole. Whom to court? The Chief Minister, whose Davos 2025 haul of ₹1.79 lakh crore sounds impressive but stalls in implementation? Bureaucrats, whose single-window portal glitches more than it grants? Revanth's "unofficial associates" – power brokers pulling strings from shadows? Industry Ministers, Finance mandarins, or the distant AICC high command in Delhi, vetting every rupee for loyalty? This carousel of confusion breeds distrust. "They weigh you like cattle – BJP ally or Congress crony?" griped a Fortune 500 exec scouting data centers, opting for Vizag's streamlined Naidu-Lokesh duo instead.

Policies? A patchwork quilt of half-measures. AP's Deep Tech Policy 2024 dangles 30% capital subsidies and land rebates, drawing NVIDIA and Foxconn. Telangana's EV push? Mired in delays, with approvals lagging 40% behind targets. Drive and strategy? Naidu's son Nara Lokesh jets to Silicon Valley weekly, sealing ₹45,000 crore in AI deals; Revanth's team? Reactive firefighting, not proactive poaching.

Ease of doing business, once Telangana's crown, now feels like a relic. Both states tie for top ranks at 98.78% compliance, but AP's edge shines in execution: single-desk clearances in 15 days vs. Telangana's 45-day morass. Corruption? Telangana's Anti-Corruption Bureau nabbed 148 cases in 2025's first half, seizing ₹39 crore in graft assets – from RTA bribe rackets to Kaleshwaram mega-scam probes handed to CBI. Still, delays in prosecutions let bribe-takers linger in service, eroding trust. Vizag's checkposts? Digitized overnight post-raids, mirroring AP's zero-tolerance vibe.

Communication? A farce. Investors get VIP red-carpet promises, then ghosted by feuding factions. Bureaucratic obstruction? Rampant – files bounce between departments like pinballs, with "speed money" the unspoken lubricant. No clear point-person exists; KTR was that North Star, greenlighting ₹40,000 crore at WEF 2024 solo. Now? A hydra of vetoes.

The fallout? Hyderabad's back seat is no metaphor. Vizag's GDP contribution to AP hit 15% in 2025, up from 8%, with FDI inflows tripling to ₹2 lakh crore. Hyderabad's? Stagnant at 7% GSDP growth, trailing AP's 14% surge. Pharma firms eye Genome Valley exits for AP's coastal clusters; IT majors reroute expansions to Amaravati.

Public opinion is favouring quick decision making, faster implementation of policies like the one watching in AP now. The father and Son duo needs no one’s permission in the state and they have the blessings of the Union government. Public pulse? Boiling over. "KTR for CM – he's the only one who delivers," echo Hyderabad's entrepreneurs at chai stalls and boardrooms. Polls show 62% favor his return, citing quick decisions and commitment-keeping akin to Naidu-Lokesh's tandem. Whispers of a BRS-BJP alliance grow louder: "Like AP's Naidu-BJP bromance, it unlocks Centre's coffers – PLI schemes, infra grants," says a T-Hub Techie.

This isn't inevitable. Telangana must forge a one-point contact – revive KTR's model, sans politics. Aggressively pursue: Roadshows in Dubai, Tokyo; slash red tape to AP levels; digitize approvals fully. Else, Hyderabad's advantages – talent, land, legacy – become tombstones.

Hands Tied, Helpless

Red-Tape Nightmare Pushes Investor to AP's Fast Lane

In the high-stakes arena of economic diplomacy, Telangana's ambitions for foreign direct investment are unraveling under a web of bureaucratic inertia, leaving state ministers feeling like spectators in their own game. While neighbouring Andhra Pradesh (AP) races ahead with streamlined approvals and one-man-show efficiency, Telangana's once-promising MoUs are gathering dust, driving away investors desperate for action over assurances.

The stark contrast was laid bare this week when a prominent foreign investor, speaking anonymously to this correspondent, abruptly terminated a memorandum of understanding (MoU) with the Telangana government. The deal, inked with fanfare at a recent investment summit, promised subsidies, discounted land allotments, and regulatory concessions to establish a cutting-edge manufacturing facility in Hyderabad's outskirts. But months later, the project remains mired in limbo. Often the minister concerned is both helpless and hand tied. Despite clearing all the permissions from the ministry, implementation is delayed due to delays in other departments, ministries concerned. From revenue, Power to other departments delay the implementation.

"It's a classic case of signed on paper, stalled in practice," the investor lamented. "In Telangana, every incentive I was promised—tax rebates, expedited environmental clearances, even basic land pricing—has to snake through a labyrinth of ministries. Finance, industries, revenue, and worst of all, the Chief Minister's Office (CMO). Each desk views it with suspicion, as if I'm here to fleece the state rather than fuel its growth."

Since literally every minister in Telangana thinks he or she is a chief ministerial material, each drags his/her feet for the fear that the other one would get name and fame overshadowing them.

The Close aides of the CM feel that the minister is making good money out of the deal and they want their pound of flesh. Contrast this with AP, where Chief Minister N. Chandrababu Naidu and his son, IT Minister Nara Lokesh, have engineered a near-magical efficiency machine. Sources close to the investor reveal that after ditching Telangana, the firm pivoted to Visakhapatnam, securing all nods within a fortnight. "One call to the CM's office, one order, and it's done," an AP official quipped off-record. "No committees, no endless queries—just results." The investor's frustration boiled over into a blunt admission that underscores the dark underbelly of India's ease-of-doing-business paradox.

"It's okay if I have to grease a palm once and get the project off the ground on time, rather than wait in Telangana's uncertain purgatory," he said, his words a damning indictment of systemic delays. While bribery is illegal and corrosive, the quip highlights a grim reality: investors weigh red tape against risks, and Telangana is losing. Telangana's woes aren't isolated. Industry insiders point to a string of stalled projects— from semiconductor ventures to renewable energy parks—victimized by inter-departmental turf wars. According to the latest DPIIT rankings, AP has surged to the top 5 states for ease of doing business, crediting its single-window clearance portal and AI-driven approvals.