Banks vs Post Offices:

31-12-2025 12:00:00 AM

Who’s Paying More

Bhumika Rajpurohit

A short viral video on social media has triggered a nationwide debate over where Indians should park their hard-earned savings, reopening an old but unresolved question: are post office schemes now more rewarding than bank fixed deposits? Shared on X by user @_vatsalasingh, the video claims that several government-backed post office schemes deliver better returns than FDs offered by leading banks such as SBI, HDFC and ICICI, a claim that has struck a chord with thousands of viewers.

The timing of the video has added fuel to the discussion. With inflation hovering between five and six percent and the Reserve Bank of India easing interest rates through recent repo rate cuts, bank FD returns have softened across most tenures. Against this backdrop, the viral clip positions post office schemes as “hidden gems” that banks allegedly do not highlight, sparking curiosity and skepticism in equal measure.

The video opens with a provocative line suggesting that banks deliberately avoid telling customers about better alternatives. Using simple drawings and Hindi narration, it argues that post office savings schemes provide “mota return” or higher returns than bank FDs, while also offering stronger safety due to sovereign backing. This framing has resonated with conservative investors who prioritise capital protection over aggressive growth.

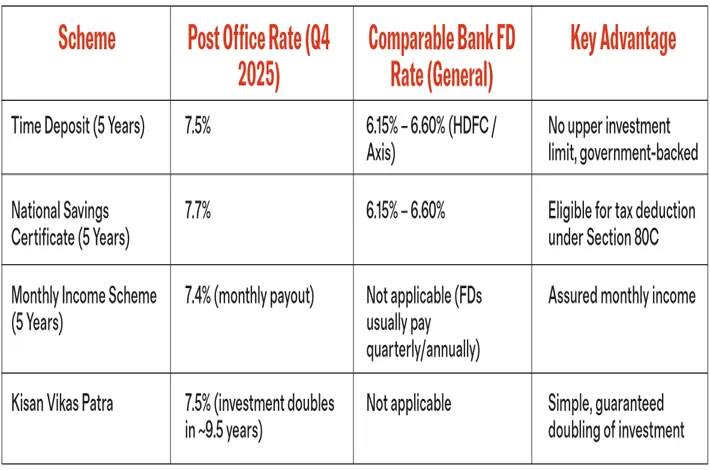

Central to the argument is a comparison of interest rates. The first scheme highlighted is the Post Office Time Deposit, often compared to a traditional FD. For a five-year tenure, the scheme currently offers interest of around 7.5 percent, noticeably higher than most large banks. The video stresses its accessibility, noting that investments can start from as little as Rs 1,000 with no upper limit, making it attractive for both small and large savers.

Next comes the National Savings Certificate, which offers about 7.7 percent interest over a five-year lock-in period. The video underscores the added advantage of tax deductions under Section 80C, presenting the NSC as a dual-benefit product combining assured returns and tax savings. For viewers wary of market-linked instruments, this point has added to the scheme’s appeal.

The debate intensifies when the focus shifts to regular income options. The Monthly Income Scheme is presented as a steady cash-flow tool, offering around 7.4 percent interest paid monthly. While bank FDs typically pay interest quarterly or annually, the MIS is pitched as a reliable alternative for households that depend on consistent monthly income, despite having defined investment limits.

Senior citizens, a key demographic for fixed deposits, have emerged as central figures in the online discussion. The video highlights the Senior Citizen Savings Scheme, which currently offers about 8.2 percent interest with quarterly payouts. Compared to senior citizen FD rates from banks, which generally range between 6.6 and 7.1 percent, the SCSS appears significantly more attractive. Its higher investment cap and government guarantee have led many commenters to label it a clear winner for retirees.

The final scheme mentioned, Kisan Vikas Patra, is portrayed as a straightforward long-term investment that doubles money in just over ten years. Though not a direct FD substitute, it is positioned as a safe option for those who prefer simplicity and certainty over flexibility. The idea of a guaranteed doubling has found favour with traditional savers, particularly in semi-urban and rural areas.

Supporters of the video’s argument point to the security factor. Post office schemes are backed by the Government of India, while bank deposits are insured only up to Rs 5 lakh per depositor. In an era of financial uncertainty, this sovereign guarantee has become a powerful selling point, especially for those with larger savings.

However, critics argue that the comparison tells only part of the story. Financial experts caution that post office schemes often lack the liquidity and convenience offered by bank FDs. Premature withdrawals can be more restrictive, and most post office products do not offer features such as overdraft facilities or seamless digital management. Taxation on interest income, they add, can also reduce effective returns.

Analysts also stress that the video overlooks alternative investment avenues. While post office schemes may outperform FDs in the current rate cycle, younger investors with longer horizons could potentially earn higher real returns through mutual funds or other market-linked products. The choice, they argue, should depend on age, income needs, risk appetite and financial goals.

Despite these counterpoints, the video’s popularity reflects a growing awareness among Indians about interest rates and investment efficiency. With hundreds of millions of post office accounts already in existence, the renewed attention suggests a shift in mindset, where savers are increasingly willing to question banks and explore traditional institutions with fresh eyes.

As the new year approaches, the debate sparked by this viral clip shows no signs of fading. Whether post office schemes truly outshine bank FDs may depend on individual priorities, but the discussion has clearly unsettled the long-held assumption that banks are always the safest and smartest choice. In 2025’s evolving economy, India’s oldest savings system has once again challenged the dominance of modern banking, forcing savers to ask where their money really works harder.