Budget 26 - A collage of feedback

02-02-2026 12:00:00 AM

While the STT hike and absence of capital gains relief disappointed, the overarching theme was one of strategic foresight: reacting not just to immediate needs but setting priorities for the next decade in AI, nuclear power, electronic manufacturing, and beyond

Who said what :

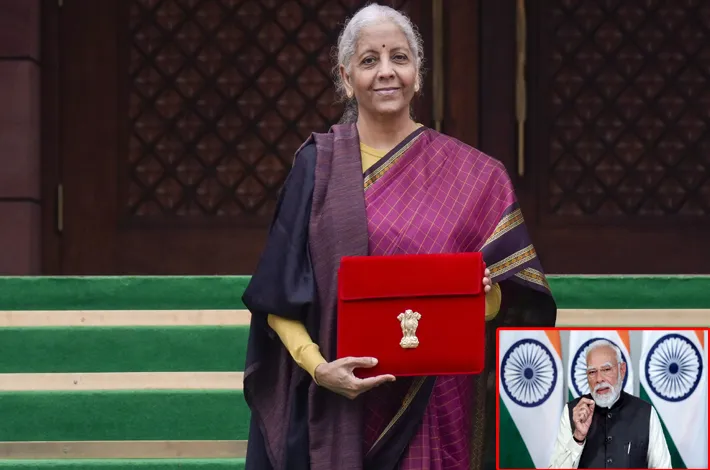

Finance Minister Nirmala Sitharaman’s announcements, including raising capital expenditure to Rs 12.2 lakh crore for FY27, a dedicated Rs 10,000 crore SME growth fund, and the launch of Biopharma Shakti with an outlay of Rs 10,000 crore over five years, were seen as key steps to promote self-reliance and inclusive growth.

- Uday Kotak, Founder and Director of Kotak Mahindra Bank highlighted fiscal discipline and increased defence spending.

- Vedanta Group Chairman Anil Agarwal called it a growth-oriented Budget that creates opportunities for youth, women, and employment-intensive sectors like medical tourism.

- Mahindra Group CEO Anish Shah said the Budget supports Atma Nirbharata and will encourage private investment, enhance productivity, and develop tier-2 and tier-3 cities as emerging economic hubs.

- RPG Enterprises Chairman Harsh Goenka described it as a “Test-match Budget” — steady and disciplined.

- Biocon Executive Chairperson Kiran Mazumdar-Shaw praised Biopharma Shakti as an investment in India’s health and innovation future.

- FICCI President Anant Goenka and ASSOCHAM President Nirmal K Minda emphasized the Budget’s focus on manufacturing, MSMEs, agriculture, and sector-specific initiatives such as Semiconductor Mission 2.0, cluster revival, and export facilitation.

- CII President Rajiv Memani noted the Budget’s balanced approach with fiscal discipline, reforms, and regulatory simplification, which will improve investor confidence, support export-led growth, and strengthen India’s competitiveness globally.

The presentation of India's Budget 2026 elicited a mix of reactions from market experts, investors, and industry leaders, with initial disappointment over unexpected tax hikes overshadowing several positive measures. As Finance Minister Nirmala Sitharaman unveiled the budget, the stock markets reacted sharply, with the Nifty dropping over 450 points at one point, reflecting some kind of “unease “

How India Inc sees it

There seemed to be an overall dissatisfaction over the hike in Securities Transaction Tax (STT) on futures and options. However, the indices recovered partially from their intraday lows, signaling a knee-jerk response rather than a sustained downturn. The budget seemed to be prioritizing fiscal consolidation while laying groundwork for long-term growth in sectors like manufacturing, infrastructure, and technology. Founder of an asset and fund management firm expressed strong pessimism, arguing that the hike—150% on futures and 50% on options—comes at a precarious time when Indian markets are already underperforming globally.

He pointed out that foreign investors (FIIs) have been disinterested, and this move could exacerbate currency depreciation and further erode confidence. "The issue is that we are underperforming like crazy in the world, and FIIs are not interested," he said, predicting a sharper market fall and a potential 1% drop in the rupee. He emphasized that while the real economy might be stable, the stock market's perception as "poor" is being amplified by such measures, especially in an environment of recent currency weakness and underperformance against global peers by 20-30% in the past year.

However, countering this view, a top executive of another asset management company downplayed the STT hike's material impact, describing it as more of a "sentiment dampener" than a substantial financial blow. He noted that the increase applies primarily to the futures and options (F&O) segment, not the cash market, and could serve as a regulatory tool to curb excessive retail trading without severely hurting overall liquidity. He agreed that markets might dip further but attributed it to broader factors like India being "out of favor" globally and upcoming IPOs sucking out liquidity, rather than the budget alone. "It's not very big because it's not on the cash market," he explained, adding that the event would likely pass in 48 hours, shifting focus back to fundamentals.

CEO of a share market investment firm explained that buybacks (he buying back by a company of its own share) were previously taxed as dividend income(share in the profits to shareholders) in the hands of recipients, often at higher rates. Now, they are treated as capital gains, with a concessional 12.5% rate for minority shareholders, 22.5% for corporate promoters, and up to 30% for individuals. This shift, he argued, encourages companies to opt for buybacks over dividends benefiting small shareholders and correcting a previous "extreme" policy that taxed recipients harshly.

Tax experts echoed this, noting it addresses corporate India's long-standing representations and could boost investor participation. However, one tax consultant remained skeptical, insisting that while buybacks are beneficial, they do little to offset the negativity from the STT hike in a sensitive market environment. Fiscal numbers emerged as a point of consensus, with the budget aligning closely with expectations. The fiscal deficit target of 4.3% was deemed reasonable and net borrowing came in at 11.7 lakh crore, matching market polls.

Another executive from an MNC investment banking firm pointed out conservatism in projections, such as higher gross borrowing offset by potential RBI switches or higher small savings inflows, which could reduce actual market borrowing. Capital expenditure (capex) growth was noted at 11.5% on a budgeted basis, though compounded over two years it hovers around 7-8%, signaling a handover to private investment. A retired bureaucrat of the Finance Ministry praised the government's realism, contrasting it with past budgets that overpromised. "The government has been very careful of giving the right numbers," he said, adding that disinvestment targets of 80,000 crore are achievable through initiatives like IDBI Bank stake sales and LIC follow-on issues.

Sectoral incentives sparked optimism for long-term growth, even as short-term market jitters persisted. Encouragement for chemicals, textiles, and exporters through targeted schemes was welcomed, with chemical stocks rising in response. Data centers received a major boost, with tax exemptions on income from overseas sales extended until 2047, allowing sales to domestic subsidiaries. Infrastructure continued as a priority, with schemes like credit guarantees and high-speed rail corridors between growth centers. Defense allocations surged 21% budget-to-budget, with capex up 24%, bolstering military preparedness and industry corridors tied to sunrise sectors like semiconductors.

Measures like raising NRI investment limits from 5% to 10% per individual and 10% to 24% aggregate were seen as practical enablers, with tax consultants and Chartered Accountants noting they resolve real-world limitations for clients. Changes to Minimum Alternate Tax (MAT) encourage migration to the new tax regime by allowing calibrated set-offs of accumulated credits, though no forward MAT credit was a point of clarification. On FDI, positives included relaxations for data centers and insurance, but a senior official from BSE argued more structural reforms are needed.

Representatives from Auto industry highlighted three specific announcements benefiting the auto industry: the removal of capex duty on lithium-ion batteries, the ECM scheme's enhancements for localization and cost reduction, and Semicon 2.0's support for advanced electronics. They also reflected on the positive impact of last year's GST reforms, which rationalized rates and boosted production in the auto components space. While some industry voices debate the pace of EV adoption and infrastructure challenges, others saw these as catalysts for growth. They argued that as more money flows into consumers' pockets via economic expansion, demand for vehicles—and by extension, auto components—will surge.

While the STT hike and absence of capital gains relief disappointed, the overarching theme was one of strategic foresight: reacting not just to immediate needs but setting priorities for the next decade in AI, nuclear power, electronic manufacturing, and beyond. As markets stabilized, the consensus was that this is a "continuity budget"—fiscally sound, inclusive, and poised to leverage India's growth story, provided private capex steps up and global headwinds ease.

MSME- The backbone. Is justice done for it?

A major concern raised was the challenges faced by Micro, Small, and Medium Enterprises (MSMEs), which form the backbone of India's economy. It was pointed out that 70% of MSMEs remain unregistered with the government, creating a significant blind spot in policy outreach. Despite a substantial Rs 10,000 crore allocation for an equity fund aimed at MSMEs, critics argued for expanding and capitalizing the Small Industries Development Bank of India (SIDBI) more aggressively. While the allocation was welcomed, the methodology of dispersal drew differing views, with some advocating for a more direct and expansive intervention to ensure funds reach the unregistered segment effectively.

An office bearer of the Associated Chambers of Commerce and Industry of India (ASSOCHAM) highlighted how the budget aligns closely with industry recommendations, emphasizing its role in propelling India's economic growth. As the head of ASSOCHAM, he noted that the organization had compiled suggestions from 17 sectors into five key pillars, resulting in 40 recommendations. Remarkably, around 24 of these were incorporated into the budget, signaling a collaborative approach between the government and industry stakeholders, he said.

He stressed the importance of ease of doing business, MSME growth, digitization, and sustainability. He praised specific budget allocations, such as the 10,000 crore outlay for MSMEs and an additional 5,000 crore directed towards tier-2 and tier-3 cities. These measures, he argued, will foster job creation in smaller urban centers, reducing the migration pressure on major metros and promoting balanced regional development. This decentralized approach could stimulate local economies and enhance overall employment opportunities.

On the ease of doing business front, the simplification of tax regimes—including customs duties and income tax—was a standout feature. Additionally, initiatives to localize rare earth metals in five states were highlighted as strategic moves to reduce dependency on imports, particularly from dominant players like China. He expressed optimism that these steps would enhance India's economic resilience, building on the progress made over the last 11 years, where the country advanced from the 10th to the 4th largest economy globally. He envisioned this trajectory leading to a "Viksit Bharat" by 2047, with a projected 35 trillion-dollar economy.

Defence- The lifeline of country

A major highlight is the defense sector, which receives special attention in the wake of Operation Sindoor—a recent military operation underscoring the need for enhanced security capabilities, including what has been termed building a robust "Sudarshan Chakra" framework. The defense allocation jumps by 15%, reaching an all-time high of Rs 7.85 lakh crore. Capital expenditure within defense sees substantial growth, supporting modernization, procurement of advanced platforms like fighter aircraft, ships, submarines, drones, and smart weapons. Particularly notable is a sharp 69% increase in allocations for intelligence agencies and related capabilities. This funding targets modern equipment, human resources, R&D, AI integration, surveillance upgrades, and asset development along borders.

A retired Lieutenant General highlighted the multifaceted threats India faces, including borders with both Pakistan and China (a 3,488 km LAC), plus internal challenges in the Northeast and Jammu & Kashmir. He argued that simple power differential comparisons overlook these complexities and the rising costs of modern intelligence tools, including AI and advanced equipment. Another Lieutenant General emphasized that precise intelligence—illustrated by Operation Sindoor's targeted strikes—enables cost-effective outcomes, destroying high-value targets with minimal expenditure on expensive hardware.

He described intelligence as a high-return investment that ensures precision rather than wasteful efforts. They highlighted the multifaceted threats India faces, including borders with both Pakistan and China (a 3,488 km LAC), plus internal challenges in the Northeast and Jammu & Kashmir. He argued that simple power differential comparisons overlook these complexities and the rising costs of modern intelligence tools, including AI and advanced equipment.

A defense expert welcomed the capital acquisition rise (around Rs 30,000 crore more) and controlled pension costs but raised broader questions: Why doesn't India's higher defense spending translate into a proportionally larger power edge over Pakistan? He urged scrutiny of whether investments target 21st-century warfare (e.g., emerging technologies) rather than traditional platforms, and whether priorities like aircraft carriers align with strategic needs for force projection in the Indo-Pacific.

Focus on growth and infra-Is it sufficient this time?

An expert from the IT sector highlighted the budget's role in securing supply chains through substantial infrastructure investments. With a capital expenditure allocation of approximately 12.5 lakh crores, including 50-year state loans, he argued that the budget provides project certainty and fosters a growth-oriented environment. He praised the emphasis on technological backbone development, which supports sectors like roads, metros, airports, hospitals, and water infrastructure on a national scale. This, he said, sends a strong message to the world about India's commitment to progress, particularly in green initiatives and manufacturing amid geopolitical shifts.

An economist and a media analyst weighed in on the budget's capital expenditure increase to 12.2 lakh crores from the previous year's 11.2 lakh crores, viewing it as a catalyst for economic insulation against external disturbances. Adikari commended the avoidance of poll populism, noting that boosted public capex encourages private investment and drives overall growth.

Key allocations target infrastructure like freight corridors, inland waterways, high-speed rail, and the development of tier-2 and tier-3 cities as economic hubs. Additionally, the budget supports peripheral sectors such as services, skilling, employment, healthcare, tourism, education, creative industries, and sports. A standout feature, according to Adikari, is the push for artificial intelligence and data centers, with tax holidays extended till 2047, alongside renewed schemes for MSMEs, which have been positioned as growth engines since 2014.

Is “play safe” approach always right?

On fiscal strategy, the budget draws mixed reactions for its conservatism. By avoiding major tax giveaways—learning from prior losses of Rs 1.4 lakh crore in income tax and Rs 1.3 lakh crore in GST—the FM maintains balance without populist adventures. Capex growth is capped modestly, aligning near nominal GDP levels, with internal reallocations favoring railways, roads, data centers, and service-led growth. Optimists call this "sensible" and stability-focused, preventing harm while enabling gradual progress.

Critics, however, snort at its lack of ambition, arguing it won't drive the 8%+ growth needed to escape the middle-income trap, which requires a 32-33% capital-to-GDP ratio. They urge bigger bets on high-tech areas like AI, biotech, and reforms in inefficient schemes.