Industrial growth crumbles to 14-month low in festive Oct

02-12-2025 12:00:00 AM

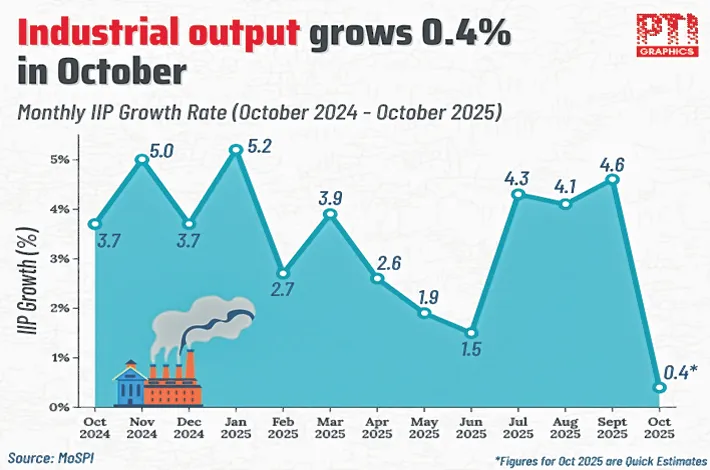

IIP: FROM 4% TO 0.4% Nine out of 23 industry groups recorded expansion

The Minstry attributed the sluggish performance to a truncated working calendar during a festival-heavy month that included Dussehra, Diwali and Chhath

India’s industrial engine lost considerable momentum in October 2025, with the Index of Industrial Production (IIP) expanding by a scant 0.4%, down sharply from 4% in September. The latest figures, released on Monday, mark the slowest pace of industrial growth in 14 months and point to a broad-based moderation across key sectors.

The quick estimates placed the IIP at 150.9, barely above the 150.3 recorded in October 2024. Mining output slipped to an index level of 126.2, manufacturing inched up to 151.1, while electricity output fell to 193.4.

The Ministry of Statistics & Programme Implementation attributed the sluggish performance to a truncated working calendar during a festival-heavy month that included Dussehra, Diwali and Chhath. Sectoral growth reflected this disruption: mining contracted 1.8%, electricity generation plunged 6.9%, and manufacturing managed only 1.8% growth. The extended monsoon and markedly cooler weather further reduced power demand, exacerbating the dip in electricity output.

Manufacturing presented a mixed picture. Only 9 of 23 industry groups at the NIC two-digit level posted year-on-year growth. The strongest performers were basic metals (6.6%), coke and refined petroleum products (6.2%), and motor vehicles, trailers and semi-trailers (5.8%). Robust output of HR coils, alloy steel flats, diesel, petrol, hard coke, auto components, and both passenger and commercial vehicles supported the uptick.

Use-based data revealed uneven momentum: indices stood at 148.9 for primary goods, 111.8 for capital goods, 166.5 for intermediate goods, and 197.2 for infrastructure and construction goods. Consumer durables and non-durables were at 129.2 and 139.9, respectively.

Corresponding year-on-year growth rates were subdued: primary goods (-0.6%), capital goods (2.4%), intermediate goods (0.9%), infrastructure and construction goods (7.1%), consumer durables (-0.5%), and consumer non-durables (-4.4%). Infrastructure and construction goods, intermediate goods and capital goods remained the key positive contributors to October’s modest overall rise.