Mkt rally runs out of breath after record-breaking highs

02-12-2025 12:00:00 AM

India’s equity benchmarks lost steam on Monday, slipping into modest decline after touching fresh lifetime highs, as investors locked in profits and foreign portfolio outflows tempered enthusiasm at elevated levels.

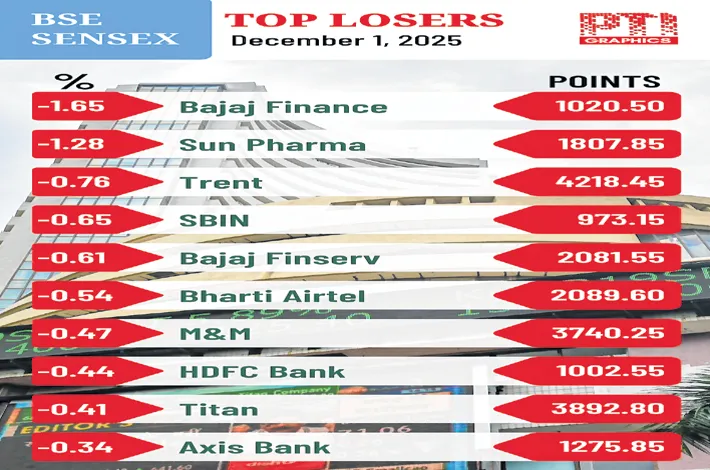

The 30-share BSE Sensex, which had surged 452.35 points to a new intraday peak of 86,159.02, eventually pared gains to close 64.77 points lower at 85,641.90. The NSE Nifty50 followed suit, ending 27.20 points down at 26,175.75 after briefly scaling a historic 26,325.80.

Vinod Nair, Head of Research at Geojit Financial Services, said the market’s swift shift into consolidation reflected diminishing hopes of an imminent rate cut by the Reserve Bank of India. “The stronger-than-expected Q2 GDP growth, coupled with the sharp depreciation in the rupee, has effectively pushed back expectations of monetary easing,” he observed. “Additionally, softer GST collections in November, partly due to lower rates, have injected an undertone of caution.”

A few market experts, however, believe that there are possibilities of a rate cut. Despite the broader market’s hesitation, the auto index outshone peers, buoyed by robust November sales. Analysts cited GST rationalisation, easing inflation, and strong wedding-season demand as key drivers behind the sector’s resilient performance.

Dr V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said the record highs painted a misleading picture of market health. “The index has hit a new high, but the market hasn’t. For a large segment of retail investors, portfolio values remain below the September 2024 peaks,” he noted. He highlighted the narrow nature of the rally, pointing out that eight heavyweights — HDFC Bank, RIL, ICICI Bank, Bharti Airtel, L&T, ITC, Infosys and SBI — collectively account for half of the Nifty’s weight. “When a handful of these move up, the index rises, even though 330 stocks in the NSE 500 continue to trade below last year’s highs.”