Investors cautious amid rising Mideast conflict

18-06-2025 12:00:00 AM

TROUBLING DIMENSION | Strong macros to stem the tide of unexpected crisis

Palazhi Ashok Kumar mumbai

Markets turned cautious on Tuesday amid escalating Middle East tensions and rising crude oil prices. Despite the escalation in the Iran-Israel conflict, retail investors had been using “every dip” in the market as a buying opportunity, and valuations did not deter their mood until Monday.

“Apparently, President Trump’s remarks (“Iran cannot have a nuclear weapon. It’s very simple—you don’t have to go too deep into it. They just can’t have a nuclear weapon. Everyone should immediately evacuate Tehran!) are pushing oil prices to new highs as we foresee the conflict to intensify further.

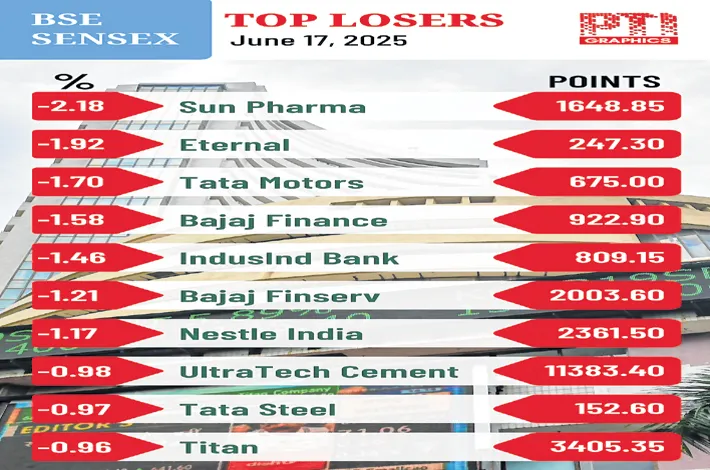

“Reports of two oil tankers collided and caught fire near the Strait of Hormuz may also affect oil supply and prices. Although, there are no signs of production losses stemming from the present conflict, tensions in shipping prevail,” market gurus pointed out. Brent crude climbed 1.69% to $74.47 a barrel. The 30-share BSE Sensex lost 212.85 points to settle at 81,583.30. The 50-share NSE Nifty declined 93.10 points to 24,853.40.

“During the last four trading days until Monday (after the conflict started), FIIs sold stocks for Rs 8,080 crore. This FII selling has been completely eclipsed by domestic institutional investors (DIIs) buying of Rs 19,800 crore. Sustained retail funds flows, mainly through SIPs, are empowering DIIs to buy consistently. Even while exercising some caution, it makes sense to remain invested in this market and to buy the dips,” Dr VK Vijayakumar, chief investment strategist, Geojit Investments, told The Free Press Journal.

“The benchmark equity index experienced moderate losses in the midst of rising risk of an escalation of geopolitical conflicts and the Fed’s (FOMC) meeting outcome this week. “This uncertainty pushed Brent crude prices higher—an unfavourable development for India, given its heavy reliance on oil imports, thereby dampening earnings growth. In the broader market, key sectors such as auto and metals came under selling pressure,” said Vinod Nair, head of research at Geojit Investments.