Markets upbeat as steady inflows into MFs continue

08-10-2025 12:00:00 AM

The Indian equity market settled on a positive note for the fourth consecutive session on Tuesday on massive buying support from Indian institutional investors.

“The steady inflows into mutual funds, particularly the SIP inflows, is a strong support to the market. The prevailing uptrend has the potential to gain momentum as the FII selling in India is gradually declining. On Monday FIIs’ selling figure stood lower at Rs 313 crore, and this was totally eclipsed by the massive buying of Rs 5,036 crore by domestic institutional investors. On Tuesday, FIIs/FPIs bought securities worth Rs 1,440.66 crore, and DIIs bought securities worth Rs 457.52 crore,” senior analysts told FPJ Money.

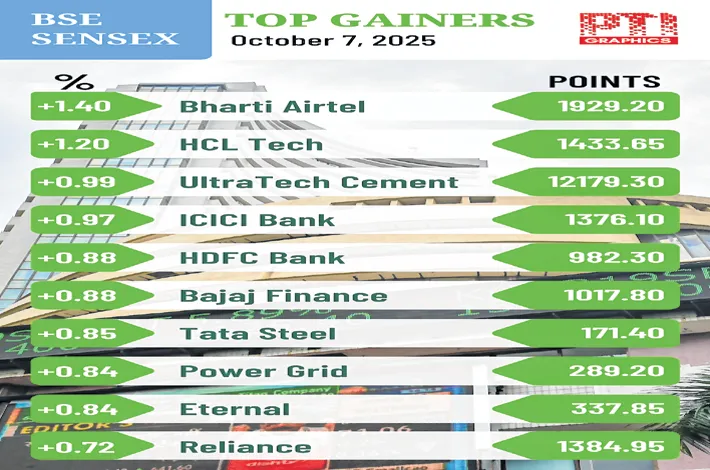

Benchmark indices continued the upward trajectory amid heightened volatility due to the weekly Nifty options expiry. The 30-share BSE Sensex rose by 136.63 points to close at 81,926.75 after a see-saw trade. During the day, it jumped 519.44 points to 82,309.56. The 50-share NSE Nifty climbed 30.65 points to 25,108.30.

“Market’s short-term focus will shift toward corporate commentary for insights into potential recovery in Q3 working results. Sectoral performance was mixed with financial stocks advancing on the back of RBI reforms, whereas FMCG stocks underperformed due to subdued pre-result updates,” said Vinod Nair, head of research at Geojit Investments.

“The combined effect of the income tax cut, GST cuts and low interest rate regime can impart resilience to India’s GDP growth, and corporate earnings in FY27 can smartly pick up to about 15%. The market will start discounting this soon. Time for investors to turn positive. Since there is a huge short position in the market, any positive news can trigger short-covering, further boosting the market-sentiment,” Dr. VK Vijayakumar, chief investment strategist at Geojit Investments.