Falcon MD held in major digital investment fraud case

07-01-2026 12:00:00 AM

Police stated that investors were promised high short-term returns, leading to large-scale public participation. In total, around Rs 4,215 crore was collected from 7,056 depositors across various regions

In a major breakthrough in one of Telangana’s biggest digital investment fraud cases, the Crime Investigation Department (CID), Telangana, has arrested Amar Deep Kumar, Managing Director of Falcon Invoice Discounting, in connection with a massive scam involving unauthorised deposit collection and cheating investors of Rs 792 crore.

According to police sources, Amar Deep was taken into custody late on Monday night at Mumbai Airport shortly after he arrived from Iran. His arrest was executed based on a Look Out Circular (LOC) issued earlier against him, following alerts generated at immigration. After being apprehended, he was placed on transit remand and is being brought to Hyderabad for further investigation.

The case pertains to the unauthorised collection of deposits involving criminal breach of trust, cheating, and criminal conspiracy by M/s Capital Protection Force Pvt. Ltd., which was operating under the brand name Falcon Invoice Discounting. Investigators revealed that the accused created a fraudulent website, www.falconsgrup. com, and a mobile application to lure investors. Through these platforms, fake invoice discounting deals were shown in the names of reputed multinational companies to gain credibility and induce investments.

Police stated that investors were promised high short-term returns, leading to large-scale public participation. In total, around Rs 4,215 crore was collected from 7,056 depositors across various regions. Of these, 4,065 victims were allegedly cheated, resulting in a confirmed loss of Rs 792 crore.

Based on multiple victim complaints, cases bearing Crime Numbers 10, 11 and 12 of 2025 were registered at the Economic Offences Wing (EOW) Police Station, Cyberabad. The cases were booked under Sections 316(2), 318(4), and 61(2) of the Bharatiya Nyaya Sanhita (BNS), along with Section 5 of the Telangana State Protection of Depositors of Financial Establishments (TSPDEF) Act, 1999. Subsequently, the cases were transferred to the CID, Telangana, for detailed investigation.

So far, 11 accused persons, including directors, senior executives, and a Chartered Accountant linked to the company, have been arrested and remanded to judicial custody. During the course of the investigation, the CID has identified assets worth approximately Rs 43 crore. These include 12 plots, four luxury cars, Rs 8 lakh in cash, 21 tulas of gold, RDP shares valued at Rs 20 crore, and bank balances amounting to Rs 8 crore. The process of attachment of these assets is currently underway.

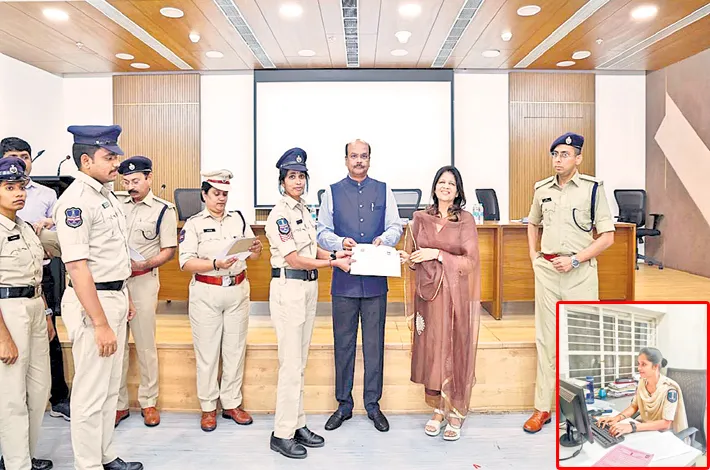

The investigation is being conducted under the supervision of Charu Sinha, IPS, Additional Director General of Police, CID, Telangana. Efforts are ongoing to trace the complete money trail and identify additional beneficiaries of the scam.

Issuing a public advisory, the police have cautioned citizens to remain vigilant and avoid falling prey to online investment schemes that promise unrealistic or unusually high returns.