Mkts go south on FII fund outflows

01-10-2025 12:00:00 AM

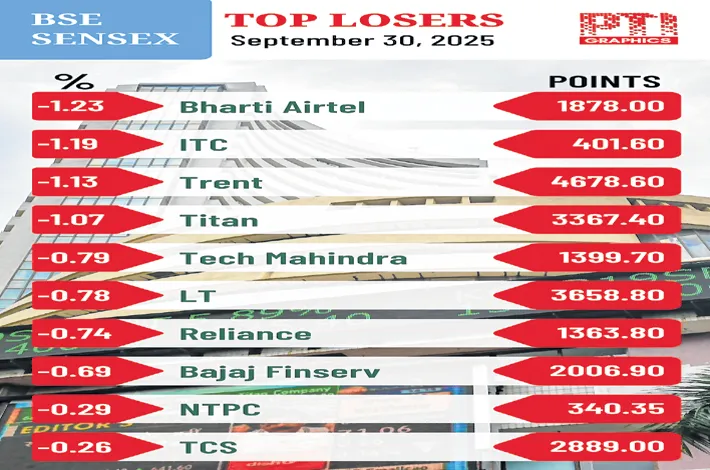

Key indices Sensex and Nifty settled lower for the eighth consecutive session on Tuesday on persistent FII fund outflows. Moreover, investors remained cautious ahead of the RBI’s interest rate decision today (Oct 1). The 30-share BSE Sensex lost 97.32 points to settle at 80,267.62. During the day, it hit a high of 80,677.82 and a low of 80,201.15. In eight trading days, the Sensex has tanked 3.30%. The 50-share NSE Nifty fell by 23.80 points to 24,611.10.

“The domestic market traded within a narrow range on the monthly expiry day as investors exercised caution ahead of the RBI’s policy decision on key rates. The market made an attempt to stabilize after last week’s sustained decline. Sectoral performance was mixed, with gains observed in metal and banking stocks, while realty and consumer durables faced selling pressure. Market participants are keenly awaiting the RBI’s commentary for insights into future interest rate trajectories, although a status quo on rates is widely expected. The near-term market outlook remains cautious, with price action likely to stay range-bound. Key developments, particularly regarding tariff policies and the upcoming earnings season, will be crucial in shaping the market’s trajectory beyond the current range,” said Vinod Nair, head of research at Geojit Investments.

“The near-term market structure appears weak. Sustained FII selling and absence of positive triggers are preventing any strong recovery in the market. Any attempt to climb up is facing selling pressure. This is evident from the negative Monday’s closing despite the positive institutional inflow. Long-term investors can use this drift in the market to accumulate the potential winners of the medium to long-term. Priority can be given to segments which are seeing good demand and order inflows. Defence stocks are fairly valued given their robust order pipeline. High quality financials are attractively valued. PSU banks are cheap,” Dr. VK Vijayakumar, chief investment strategist at Geojit Investments, said.