RBI’s lending reforms boost mkt sentiment

07-10-2025 12:00:00 AM

The domestic equity market settled on a positive note on Monday, led by gains in the financial services and IT sectors, ahead of the Q2 results. Investors anticipate robust credit growth in bank credit and stable lending margins. The 30-share BSE Sensex jumped 582.95 points to close at 81,790.12. During the day, it gained 639.25 points to 81,846.42. The 50-share NSE Nifty surged by 183.40 points to 25,077.65. Nifty advanced 466 points in three sessions to reclaim the 25,000-level on value buying.

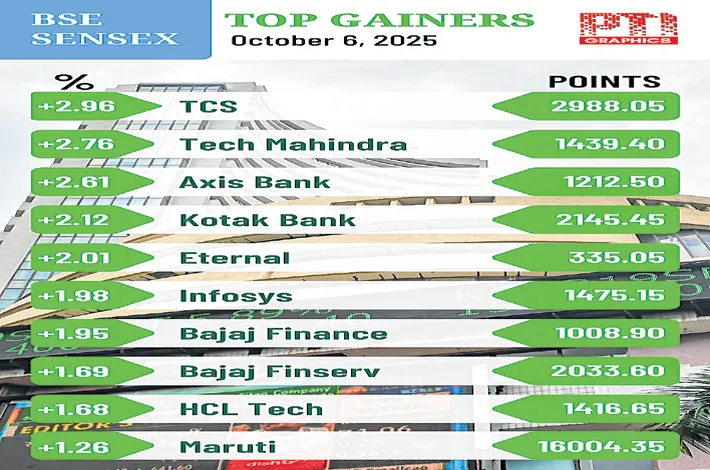

TCS, Tech Mahindra, Axis Bank, Bajaj Finance, Eternal, Infosys, Kotak Mahindra Bank and Bajaj Finserv were the top gainers. Tata Steel, Adani Ports, Power Grid and Titan were among the top losers.

“The banking index outperformed, bolstered by strong quarterly updates announced by large scheduled banks and attractive valuations, while hospital stocks surged following the revision of CGHS rates. Investors now look to Q2FY26 earnings for guidance; though expectations remain moderate, the market is more optimistic regarding Q3 results, led by a rise in consumer demand,” said Vinod Nair, head of research, Geojit Investments. The positive sentiments triggered by the growth stimulating monetary policy face headwinds from the continuing FII selling, but can be sustained by positive news on growth and corporate earnings for FY27. “Growth is likely to remain strong assisting in corporate earnings growth of above 15% in FY27. The market will be looking forward to a positive resolution of the U.S.-India trade tensions. A trade deal can turn out to be a trigger for a rally in the market.

“We will have to wait and watch for developments on this front. Fresh money flowing to the market is chasing domestic consumption themes like automobiles, financials and banking, telecom, aviation, metals, cement and digital platform companies. This trend is likely to sustain. The Q1 data on credit and deposit growth from Kotak Mahindra Bank look impressive,” Dr. VK Vijayakumar, chief investment strategist at Geojit Investments, said.

According to Bajaj Broking Research, benchmarks settled on a strong note, with the Nifty 50 comfortably crossing the 25,000-mark, reaffirming the prevailing bullish sentiment. Markets extended their winning streak for the third consecutive session, buoyed by firm global cues and renewed optimism ahead of the Q2 earnings season.