Renewed geopolitical tensions push investor sentiment lower

25-06-2025 12:00:00 AM

FPJ News Service mumbai

Sentiment remained cautious on Tuesday on renewed geopolitical tensions in the Middle East. After surging 1,121.37 points (1.36%) to 83,018.16 in intra-day trade, the 30-share Sensex later lost most of its gains as reports surfaced of the ceasefire plan faltering. But, the benchmark still managed to settle in the green, climbing 158.32 points to 82,055.11.

“Initial gains in the domestic market, driven by the ceasefire announcement and sharp drop in crude prices, were short-lived as renewed geopolitical tensions pushed investor sentiment lower. Adding to the uncertainty was heightened volatility due to expiry day dynamics. Although the market attempted to break out of its recent consolidation range, persistent global risks continue to impede momentum.

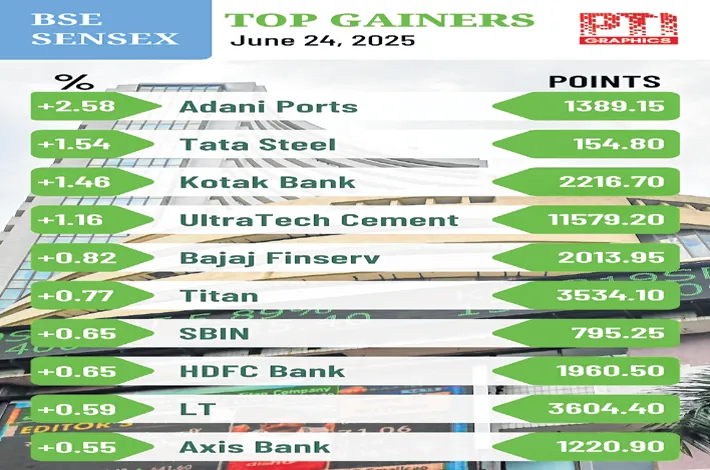

Going forward, the sustainability of an uptrend will hinge on the strength of domestic earnings, with optimism surrounding the upcoming Q1 results supported by favourable domestic macroeconomics,” said Vinod Nair, head of research at Geojit Investments. Reports of ceasefire violation between Israel and Iran, and the emergence of profit-taking dampened the overall market mood. Adani Ports, Tata Steel, Kotak Mahindra Bank, UltraTech Cement, Bajaj Finserv and Titan were among the top gainers.

In Asian markets, South Korea's Kospi, Japan’s Nikkei 225 index, Shanghai’s SSE Composite index and Hong Kong's Hang Seng settled significantly higher.