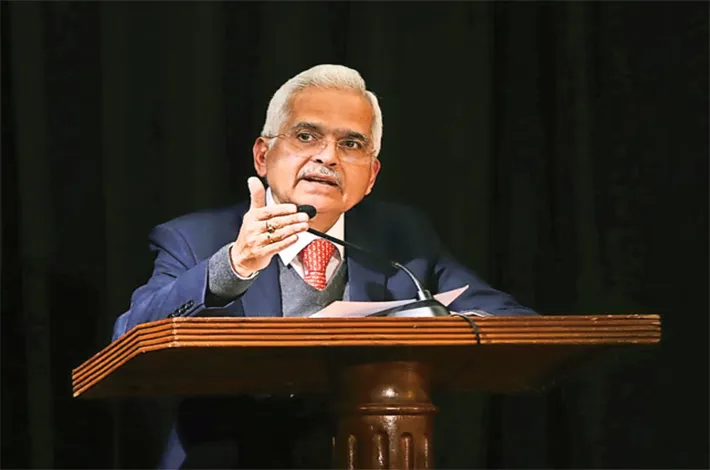

Sebi chief calls for cyber resilience to curb threats

09-10-2025 12:00:00 AM

Cybersecurity threats have the potential to create systemic disruptions. A single data breach or operational glitch can have cascading effects across interconnected systems, the capital market regulator’s chairman Tuhin Kanta Pandey said on Wednesday.

As market participants increasingly rely on third-party service providers and cloud-based platforms, new vectors of risk emerge —sometimes beyond traditional regulatory perimeters.

“As we look to the future, we envision a securities market that is not only efficient and resilient but also deeply inclusive-powered by innovation and technology for the benefit of all participants,” Pandey said at the annual GFF here.

Under Sebi’s Innovation Sandbox, fintechs are testing the applications of blockchain technology in the securities market. Further, to address post quantum cryptographic issues, “we have prepared an action plan as well as capacity building initiatives on quantum readiness of its regulated ecosystem.

“But the resilience cannot be built by the regulator alone. It is a shared responsibility- among MIIs, intermediaries, fintech innovators, and indeed, all of us in this ecosystem. As we enter the next phase of this transformative journey, the collaboration between fintech innovations and regulatory foresight will determine not just how fast we grow, but how safely we grow,” Pandey added.

India’s capital markets today are among the most efficient and technology driven in the world. But our true strength lies in the resilience of the market ecosystem and the inclusion of all stakeholders.

Technology has also become the regulator’s most potent ally. “Leveraging technology in our supervisory process, we conduct off site inspections, supervise market infrastructure institutions and do continuous monitoring of intermediaries,” Sebi chief said. To enable real-time oversight and to relieve the reporting burdens on businesses, Sebi has introduced system-driven disclosures. The regulator’s data analytics and digital forensics laboratory uses advanced analytics, AI/ML models to detect complex market manipulation patterns and network-based frauds.