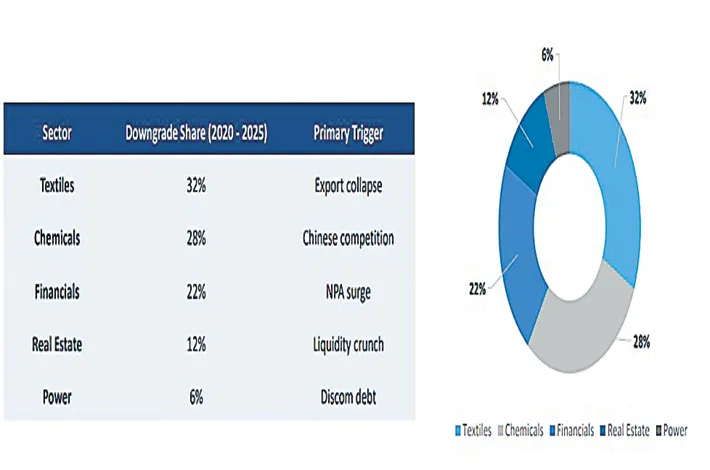

Sector wise credit rating downgrades in last 5 years

04-05-2025 12:00:00 AM

From 2020 to 2025, several Indian sectors have faced significant credit rating downgrades primarily influenced by both global and domestic economic factors. Key sectors affected include textiles, chemicals, financial services, real estate, and conventional power generation, with each experiencing unique challenges. The effect of downgrading of credit ratings was different for different sectors.

For example, the textile sector was hit hardest due to declining export demand, escalating raw material prices, and competition from cheaper Chinese imports. Many small and mid-sized enterprises (SMEs) in this sector found themselves under severe financial duress, leading to cash flow challenges and credit rating repercussions. It recorded a 32% of credit rating downgrades.

The chemicals sector experienced a 28% downgrade share, largely due to commoditization and pricing pressures resulting from Chinese exports. Rising crude oil prices and energy costs squeezed margins for both major corporations and smaller players. Additionally, the burden of complying with environmental regulations further challenged smaller firms.

Accounting for 22% of rating downgrades, the financial services sector faced a surge in NPAs post-pandemic, coupled with liquidity pressures due to NBFC crisis of 2019. As banks tightened credit and regulatory frameworks financial institutions experienced significant stress, although signs of recovery began emerging in H1FY25, indicating a potential turnaround on the horizon.

The real estate sector struggled with stalled projects and an inventory backlog Though the sector suffered from a liquidity crisis following the IL&FS collapse, which stunted project funding and delayed deliveries, recovery efforts took shape post-2022 with the implementation of the RERA. These reforms improved transparency and bolstered affordable housing demand post-COVID.

The conventional power generation sector faced a 6% downgrade share tied to substantial overdue payments (discom debt) and tariff renegotiations which adversely affected cash flows. Additionally, a structural shift towards renewable sources of energy pulled funds away from conventional coal-based power plants and raised concerns over their long-term viability.

The comprehensive analysis of credit rating downgrades highlights the necessity for tailored reforms targeting the vulnerabilities unveiled within various sectors. Addressing liquidity issues, enhancing competitiveness against international players, and ensuring regulatory frameworks facilitate growth could markedly improve sector resilience in the Indian economy.

- by Brickwork Ratings India Pvt Ltd.