Volatility continues; investors cautious

30-09-2025 12:00:00 AM

Indices fall for 7th day

The domestic stock market concluded a volatile session on Monday on a flat note as investors turned more cautious ahead of a holiday-led truncated week and continued FII selling.

The 30-share BSE Sensex lost 61.52 points to close at 80,364.94. During the day, it hit a high of 80,851.38, and a low of 80,248.84. Falling for the seventh consecutive session, the 50-share NSE Nifty slipped 19.80 points to 24,634.90. Nifty has dropped more than 3% in the seven straight sessions due to selling by foreign investors.

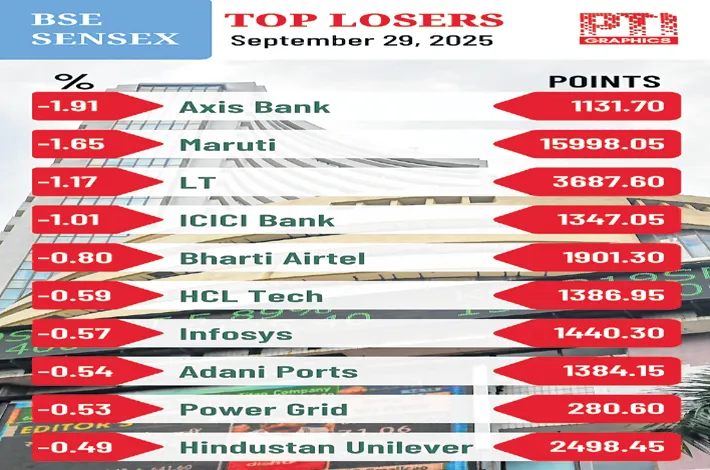

Larsen & Toubro, Maruti, ICICI Bank, Bharti Airtel, Axis Bank, Infosys and Hindustan Unilever were among the top losers. Eternal, SBI, Trent and Titan were among the top gainers.

Vinod Nair, head of research at Geojit Investments, said, “Lack of clarity in the US-India trade deal and prolonging pressure on IT and pharma indices are near-term concerns for the market. Investors await the RBI policy outcome this week; the central bank is expected to keep the rates unchanged to contain volatility in the rupee. The supportive fiscal measures and a stronger demand outlook for H2FY26 may lead the central bank to upgrade its FY26 GDP growth forecast.”

“The weakness in the broader market is likely to sustain given the valuations which continue to remain elevated. Investors can slowly accumulate largecaps in automobiles, banking, telecom, capital goods and cement. Weakness in pharmaceuticals is an opportunity to buy into the segment since India’s generic exports will not be impacted by Trump’s tariffs on patented and branded medicines,” said Dr VK Vijayakumar, a veteran investment strategist.

The market had been drifting down continuously during the last six trading sessions pulling the Nifty below the 24,800 level, which was a support zone. Technically, Dr VKV said, the market continues to be weak, but it has reached oversold levels and, therefore, a short-term bounce back is likely any time.