India makes 85% of digital payment via UPI: RBI Guv

17-10-2025 12:00:00 AM

DPPs have become a powerful catalyst for inclusive growth and innovation

PTI New Delhi

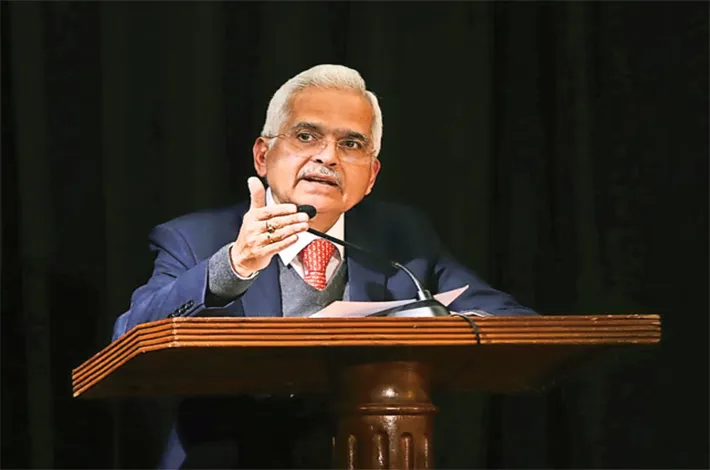

About 85 per cent of the digital payment transactions take place through UPI in India, and the country can be a case study in inclusive, secure, and scalable Digital Public Platforms (DPPs), Reserve Bank Governor Sanjay Malhotra has said.

He was speaking at a "High-Level Dialogue on Forging Economic Resilience through Digital Public Platforms" organised by RBI on the sidelines of the Annual Meetings of the World Bank and International Monetary Fund in Washington, DC on Tuesday. DPPs have become a powerful catalyst for inclusive growth and innovation.

Foundational platforms for digital identity (Aadhaar) and real-time payments (Unified Payments Interface - UPI) have successfully demonstrated how to build resilient, cost-efficient public service delivery systems at scale, the RBI Governor said. Governor Malhotra gave a brief overview of India's DPP ecosystem and their role in digitalisation and financial inclusion, especially in government transfer payments.

He emphasised that, in the true spirit of 'Vasudhaiva Kutumbakam', India is fully committed to international collaboration around such platforms to accelerate digital transformation. "For us, the guiding principle has been to build such platforms in the public sector as a public good with suitable guardrails, and without a profit motive," he said.