Investor-sentiment improves, FIIs cautiously optimistic

17-10-2025 12:00:00 AM

FPJ News Service New Delhi

Indian equities extended their pre-Diwali rally for the second consecutive session on Thursday amid renewed optimism surrounding India–US trade discussions, and cautious, but optimistic FII sentiment.

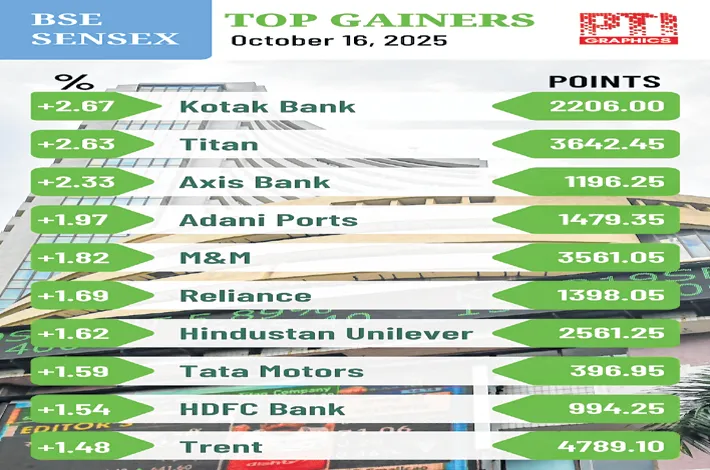

The 30-share BSE Sensex climbed 862.23 points to settle at 83,467.66. During the day, it gained 1,010.05 points to 83,615.48. The 50-share NSE Nifty gained 261.75 points to 25,585.30. Top gainers of the day included Kotak Mahindra Bank, Titan, Axis Bank, Adani Ports, Mahindra & Mahindra, Reliance Industries, Tata Motors and HDFC Bank. Infosys and Eternal, however were among the top losers. South Korea’s Kospi was up 2.49%, Japan’s Nikkei 225 index climbed 1.27%, Shanghai's SSE Composite index was marginally up, Hong Kong’s Hang Seng closed lower, markets in Europe were trading higher on Thursday, and US markets had ended mostly higher on Wednesday.

“Gains were broad-based, led by realty, auto, FMCG, and private banking stocks. Sentiment was further lifted by expectations of a Q3FY26 demand revival, early signs of FII inflows, and a softer dollar index. The recent appreciation of the rupee reinforced the positive undercurrent. While near-term momentum remains favourable, sustained performance will depend on signs of earnings growth from ongoing corporate results and developments in global trade,” opined Vinod Nair, head of research at Geojit Investments.

Dr. VK Vijayakumar, a veteran investment strategist, said, “Recent comments from the US administration indicate a possible improvement in India-US trade talks and easing of tensions, and hopes of an interim trade deal in the next few weeks. China’s tough actions regarding the rare earth magnets have hit the US hard, and, therefore, the US is keen on striking a deal with India with both countries making some concessions.

“Even though Indian macros are healthy and GDP growth projection for FY26 is being revised, India’s exports and jobs in labour intensive sectors such as textiles, gems and jewellery and leather products have been hit hard.”