Investors cautious amid potential US involvement in Mideast conflict

20-06-2025 12:00:00 AM

FPJ News Service mumbai

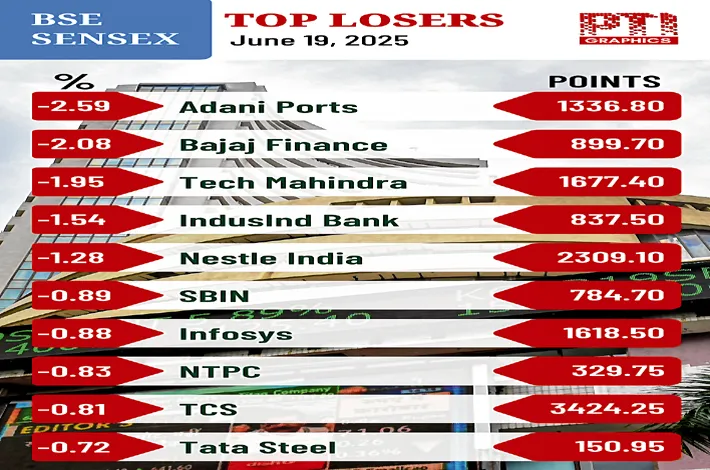

Markets on Thursday remained cautious for the third consecutive day, and indices indicated range bound movement, driven by concerns over potential US involvement in the Mideast conflict. The 30-share BSE Sensex declined 82.79 points to settle at 81,361.87. The 50-share NSE Nifty dipped 18.80 points or 0.08 per cent to 24,793.25.

Benchmark Brent crude climbed 0.26% to $76.90 a barrel. With geopolitical tensions driving crude prices higher, markets may experience new lows, and if the conflict escalates further, oil prices testing new highs of $80, cannot be ruled out.

“Cautious sentiment spread across the globe on mounting concerns over potential US involvement in the Middle East conflict. Investor mood was further affected by the Fed’s decision to keep interest rates unchanged while signalling persistent inflation and slower economic growth, which weighed on software export stocks.

Broader market performance lagged the benchmark index, influenced by selling in mid and small-caps, while better stability was noticed in large-cap growth stocks, keeping a close watch on crude oil prices and global developments,” Vinod Nair, Head of Research, Geojit Investments, said.

“Watch out for the developments in West Asia. The Fed decision and commentary have come on expected lines. Jerome Powell’s comment that “despite heightened uncertainty the economy is in a solid position” is important. However, he has warned that “tariff effects on inflation can be persistent”. Therefore, it would be realistic not to expect rate cuts from the Fed immediately. The dot plot, however, indicates two rate cuts in 2025.

With only 1.4% GDP growth expected this year, the US is unlikely to attract a lot of capital flows. This is favourable for India. But since Indian market valuations remain a concern, sustained rally will happen only when we get indications of sustained earnings growth, which is some time away,” said veteran investment strategist Dr VK Vijayakumar.