Investors chasing resilience, not dazzling short-term gains

08-05-2025 12:00:00 AM

FPJ News Service mumbai

Intelligent investors on Wednesday reconfirmed their ‘mantra of chasing resilience’, and not dazzling short-term returns. Indian investors have been scrambling into havens such as gold, and diversifying investment portfolios by buying fundamentally strong stocks after the markets started witnessing massive FII outflow from Jan-March.

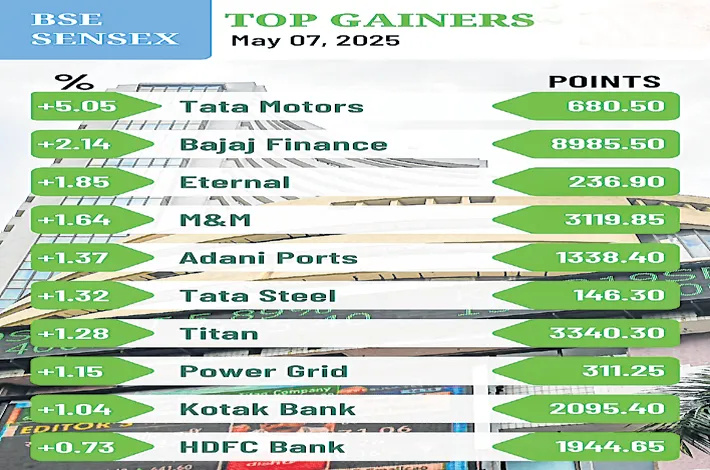

During the first 3 months of 2025, FIIs have been big sellers. Cumulatively FIIs sold equities for nearly Rs 1.30 lakh crore during this 3-month period. Key indices Sensex and Nifty settled higher on Wednesday as India launched missile strikes “Operation Sindoor” on terrorist hideouts in Pakistan and POK. The 30-share BSE Sensex closed 105.71 pts higher at 80,746.78. The Nifty 50 advanced by 34.80 pts to settle at 24,414.40.

“Historical data suggests that the Indian stock market has generally responded with resilience to serious geopolitical events. Except for the Parliament attack in 2001, all other incidents led to positive market returns over the medium to long term,” said Abhishek Jaiswal, Fund Manager at Finavenue.

“Mkts exhibited strong resilience amid recent Indo-Pak border tensions, the measured market response indicated that geopolitical risks were largely priced in and expectations of de-escalation are prevailing among investors,” said Vinod Nair, Head of Research, at Geojit Investments. “What stands out in “Operation Sindoor” from the market perspective is its focused and non-escalatory nature.

We have to wait and watch how the enemy reacts to these precision strikes by India. The mkt is unlikely to be impacted by the retaliatory strike by India since that was known and discounted by the market. The main catalyst of the market resilience in India is the sustained FII buying of the last 14 trading days which has touched a cumulative figure of Rs 43,940 crore in the cash market. ,” said Dr VK Vijayakumar, Chief Investment Strategist, at Geojit Investments.