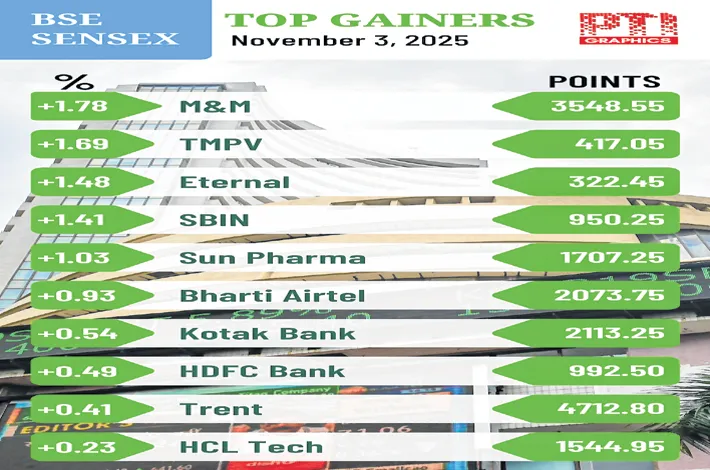

Markets record marginal gains in lackluster trading

04-11-2025 12:00:00 AM

Despite profit-booking at higher levels, the domestic markets settled on a positive note with marginal gains on Monday.

Investors were cautiously optimistic, and the 30-share BSE Sensex inched up by 39.78 points to close at 83,978.49. During the day, the benchmark touched a high of 84,127 and a low of 83,609.54. The 50-share NSE Nifty recorded a marginal gain of 41.25 points to close at 25,763.35.

“Profit-booking was visible at the higher levels due to the absence of fresh domestic triggers. While the broader market outperformed since the quarterly earnings are steering investors' preference to take a short- to medium-term view. “The PSU Banking index continued to be a preferred bet for investors, led by healthy earnings and improving asset quality. In contrast, IT stocks declined amid fading expectations of a US Fed rate cut, while a trade truce between the US and China eased the demand for safe haven assets,” said Vinod Nair, head of research, Geojit Investments.

“Profit booking and FIIs again turning sellers prevented continuation of the rally to record highs. Since the FII strategy of selling in India on rallies and moving money to other better performing markets have paid them rich dividends, they can be expected to continue the same strategy now. A change in this scenario will happen only when we have leading indicators suggesting a smart turnaround in India’s corporate earnings.

“The Trump-Xi summit delivered only a temporary truce in the US-China trade war, not a trade deal. The implications of this on a possible US-India trade deal remain to be seen. A significant trend in the industry is the sustained demand for automobiles, particularly small cars, which is turning out to be better than the optimistic expectations. Auto shares will remain resilient,” said Dr VK Vijayakumar, chief investment strategist, Geojit Investments.