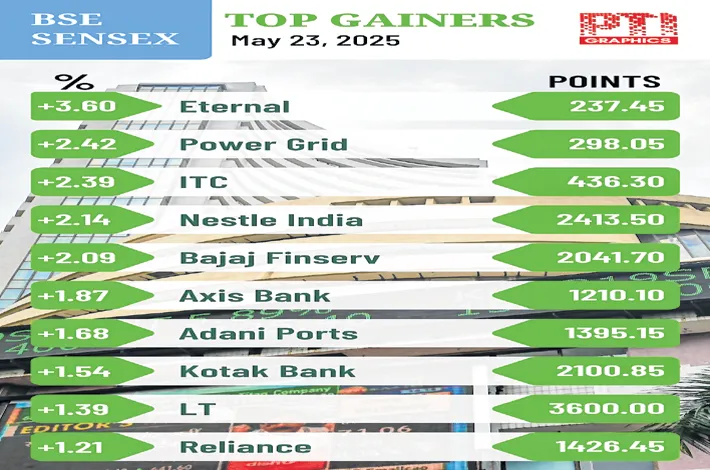

Markets recover;sentiment cautious

24-05-2025 12:00:00 AM

Despite the cautious sentiment, FIIs bought equities worth `1,794.59 cr

FPJ News Service mumbai

Markets recovered nearly half of the week’s losses on Friday, supported by gains in FMCG and IT stocks. After a flat start, the 30-share BSE benchmark bounced back and surged 769.09 points to settle at 81,721.08. During the day, it jumped 953.18 points to 81,905.17. The NSE Nifty rallied 243.45 points to 24,853.15.Despite the cautious sentiment, FIIs bought equities worth Rs 1,794.59 crore.

“FMCG benefitted from the early and above-normal monsoon forecast, while IT stocks saw a rebound following a healthy correction. Optimism around a potentially record-high dividend from the RBI boosted hopes for fiscal consolidation, reflected in falling Indian bond yields. Investor attention is further revolving around US-India trade talks, and strong domestic macroeconomic indicators. However, recent FII outflows, driven by rising US bond yields amid concerns over mounting US debt, may weigh on the market sentiment,” said Vinod Nair, head of research, Geojit Investments.

“After the 14% pull back from the March lows, the market is struggling to find direction. It appears that the sustained FII buying which played an important role in this rally has run out of steam. The big FII selling on 20th and 22nd of this month indicates that the FIIs may again turn sellers if the global environment turns unfavourable.

“There are some global concerns arising out of the sharp rise in bond yields in the US and Japan. Particularly the sharp spike in US bond yields with the 30-year yield touching 5.14 % and the 10-year yield at 4.52% reflect concerns surrounding the US debt levels and its fall out on global financial markets. It remains to be seen how this pans out.

“The silver lining from the market perspective is India’s strong macros particularly the resilient growth and declining inflation and interest rates,” underlined Dr VK Vijayakumar, chief investment strategist at Geojit Investments.