Metro price Bomb Ticking

28-10-2025 12:00:00 AM

metro india news I hyderabad

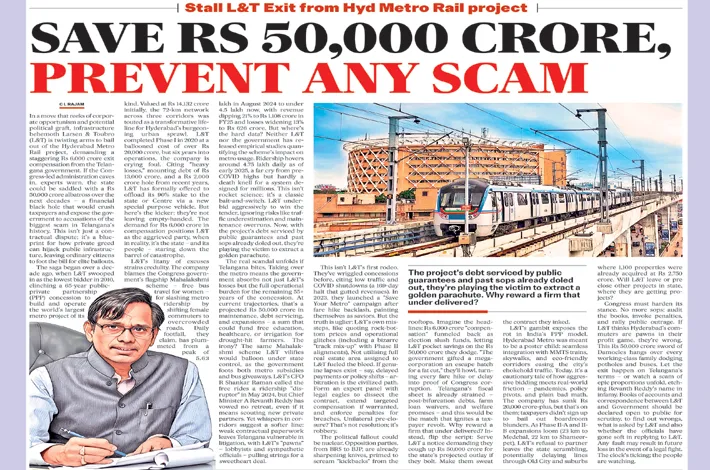

In a move that reeks of fiscal recklessness and political expediency, the Telangana government has seized control of the Hyderabad Metro Rail project from Larsen & Toubro (L&T), saddling taxpayers with a staggering debt bomb estimated at over Rs. 30,000 crore in immediate hits alone. Just weeks after jacking up bus fares to squeeze an already beleaguered public, Chief Minister A. Revanth Reddy's administration is now priming the pump for a brutal Metro ticket hike – all to bail out a private giant that's walking away unscathed.

The decision, announced last week amid a swirl of backroom deals and zero public consultation, flips the script on a 2017 public-private partnership (PPP) agreement that handed L&T operational reins. Critics, including watchdog group Metro India and journalist collective Vijayakranthi, had sounded the alarm bells a full seven days prior in a blistering exposé, warning of "catastrophic losses" if the state swallowed the project whole. Their pleas? Ignored like yesterday's headlines.

Metro India has laid it out in black and white: L&T's been bleeding red ink, but letting them pre-close the contract without penalties is a gift-wrapped exit. The government didn't just take over – it took the fall for corporate greed.

The numbers are a gut punch. Under the takeover, Telangana inherits L&T's operational losses pegged at Rs. 55,000 crore, plus a Rs. 13,000 crore loan portfolio that's now the state's albatross. Add in a cheeky Rs. 2,000 crore reimbursement to L&T for "early termination costs," and you're staring at an upfront tab north of Rs. 70,000 crore. But that's just the appetizer. Over the next 40 years – the project's extended horizon – the cumulative burden balloons to more than Rs. 50,000 crore in servicing, maintenance, and opportunity costs. It's a generational heist, doled out in installments to Hyderabad's daily commuters.

Why the rush? Sources close to the Secretariat whisper of mounting pressures: L&T's profitability cratered post-pandemic, with ridership still 30% below pre-COVID peaks due to erratic expansions and sky-high operational costs. The firm, India's engineering behemoth, had poured in Rs. 14,000 crore equity but watched it evaporate amid delays, land acquisition snarls, and a fare-capping clause that kept tickets artificially low. By mid-2025, L&T was lobbying hard for an out, citing "unsustainable losses" in quarterly filings.

Enter the state: In a cabinet nod on October 18, Reddy's team greenlit the handover, vowing to "reclaim public asset for the people." But the fine print tells a different tale. With L&T off the hook – no clawbacks on profits from the initial boom years, no penalties for underperformance – the government is left holding the bag. Thus, L&T gets to exit scot-free, pocketing reimbursements while we foot the bill. Where's the compensation clause? Buried under political favors.

The fiscal fallout is immediate and vicious. To keep the trains running – and fund the promised Phase II extensions to areas like Old City and Shamshabad – the state must rustle up Rs. 15,000 crore in fresh loans by fiscal 2026. Here's the kicker: L&T, with its AAA credit rating and market clout, historically snagged funds at a cushy 6.5% annual interest. The government? Banks are already circling like sharks, quoting 11% rates on sovereign debt amid Telangana's ballooning Rs. 3 lakh crore overall borrowings.

That 4.5% spread isn't abstract math – it's Rs. 700 crore in extra interest annually, bleeding straight from state coffers. Every year, L&T, for all its flaws, ran a tight ship: Tech-driven scheduling, private-sector procurement, and a lean workforce kept overheads in check. Under government stewardship? Brace for the bloat. Bureaucratic red tape will strangle operations,

Preliminary audits leaked to Metro India project an additional 20-25% operational loss under state control, pushing total yearly deficits to Rs. 1,500 crore. With revenues flatlining at Rs. 800 crore annually (barring hikes), the math doesn't lie. The only backstop? The public.

Whispers from transport ministry insiders point to a post-GHMC polls bombshell: Metro fares, frozen at Rs. 10-60 since inception, could surge 50-100% by December. A 10-km commute? From Rs. 40 to Rs. 80 overnight. For the 5 lakh daily riders – daily wage earners, students, IT grunts – it's a gut-wrenching squeeze. "We've already hiked bus fares 25% in September, citing 'inflation,'" fumed commuter Sunita whose group staged a flash protest at Miyapur station last week. "Now this? It's death by a thousand cuts. The poor pay for the rich's bailouts."

The irony stings. Hyderabad's Metro was sold as a gleaming symbol of Revanth Reddy's "people-first" agenda when he swept to power in 2023 on anti-incumbency waves. Phase I, spanning 69 km, was meant to decongest a city choking on 20 lakh vehicles. still under L&T's watch, it became a money pit: Cost overruns from Rs. 14,000 crore to Rs. 18,000 crore, thanks to KCR-era land scams and COVID shutdowns. The PPP model, hailed as innovative, crumbled under revenue-sharing kinks – L&T took 90% of fares until break-even, then flipped to 70-30, but break-even never came.

As GHMC polls heat up – with voting slated for November 2025 – the timing screams strategy. Announce the takeover now for "decisive leadership" optics; delay the fare pain till after ballots drop. But voters aren't blind. Social media is ablaze: #MetroScam trends with memes

This isn't just a Metro mess; it's a manifesto for mismanagement. Telangana's debt-to-GSDP ratio, already flirting with 35%, will spike, crowding out welfare spends. Expansion dreams? Deferred indefinitely. And L&T? Their stock ticked up 2% post-announcement, as analysts hailed the "clean exit."