Economic Asset or Geopolitical Target?

27-01-2026 12:00:00 AM

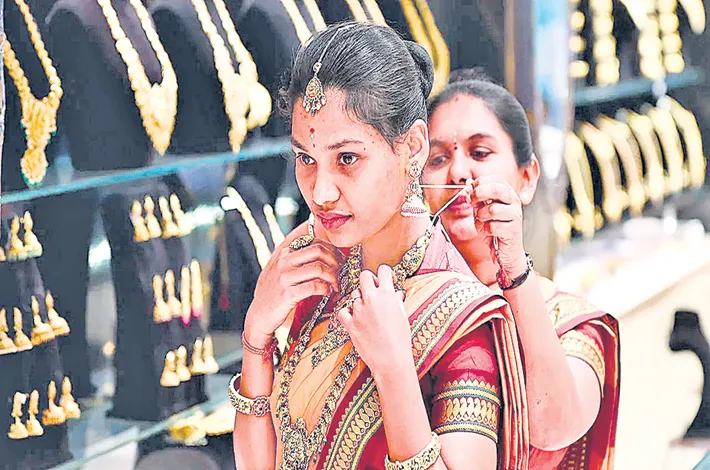

In the bustling markets of Mumbai and Delhi, gold has long been more than a metal—it's a cultural cornerstone, a hedge against uncertainty, and a family heirloom passed down generations. But, a provocative theory circulating in online forums and investor circles suggests a darker undercurrent: that the proliferation of "Cash for Gold" outfits and gold finance companies in India over the past decade might be part of a foreign adversary's strategy to siphon off the nation's vast household gold reserves, converting them into manipulable fiat currency. Proponents of this view, often citing anonymous hunches, point to communist-linked entities allegedly selling Indian gold cheaply on international markets to bolster China's imports. They warn of impending disruptions in physical gold access via exchange "issues" or global conflicts, potentially catapulting prices to $10,000 or even $15,000 per ounce. While this narrative echoes Cold War-era paranoia, a closer analysis grounded in economic data reveals a mix of legitimate concerns and unsubstantiated speculation.

India's affinity for gold is unmatched. Households hold an estimated 25,000 to 34,600 metric tons, valued at $3.8 trillion to $5.3 trillion as of late 2025, equivalent to 88-89% of the country's GDP. This represents 11-16% of all gold ever mined globally, dwarfing the U.S. Fort Knox reserves fourfold. Contrary to the 97% figure often bandied in conspiracy threads, households account for about 75-80% of India's total gold demand, with the rest split between jewelry exports, industrial use, and official reserves held by the Reserve Bank of India (around 800 tons). Still, this private dominance makes India the world's largest gold consumer, importing 700-900 tons annually, fuelled by weddings, festivals, and savings habits where gold serves as both consumption and investment.

The rise of "Cash for Gold" companies aligns with this cultural backdrop but has exploded amid economic shifts. Over the last decade, the gold loan sector—often conflated with outright cash-for-gold buyers—has grown remarkably, with assets under management surging from Rs 1.5 trillion in 2015 to over Rs 10 trillion by 2025. Non-banking financial companies (NBFCs) like Muthoot Finance and Manappuram Finance dominate, holding the largest gold loan portfolios in India. These firms offer quick loans against pledged gold, typically at 18-24% interest, without selling the asset unless borrowers default. Default rates hover around 2-3%, meaning most gold returns to owners. However, outright buyers like Attica Gold Company and chains from organized jewelers have proliferated, capitalizing on high prices that hit Rs 1,25,000 per 10 grams in 2025—a 165% rise since 2021. This growth stems from digital lending apps, post-pandemic liquidity needs, and government pushes for formalized gold monetization, not foreign intrigue.

The conspiracy's core allegation—that these operations funnel gold to China cheaply—lacks empirical backing. India is a net gold importer, sourcing primarily from Switzerland, UAE, and South Africa, with exports limited to jewelry (valued at $12 billion in 2025). China, the world's top producer and importer, added 27 tons to its official reserves in 2025, reaching 2,306 tons, but its imports come via Hong Kong from diverse sources like Australia and Russia, not India. No data indicates discounted Indian gold flooding Chinese markets; instead, Beijing's purchases reflect de-dollarization efforts amid U.S.-China tensions. About 20% of Indian household gold is pledged for loans, but this collateralizes credit without transferring ownership, adding Rs 5 trillion to the economy annually. Fraud cases in gold loans have risen, with RBI reporting multiple incidents over three years, but these involve domestic mismanagement, not international plots.

But, the theory taps into real vulnerabilities. Global gold markets have seen "physical delivery crises," with 2025 bottlenecks causing delays and premiums as demand for bars and coins outstripped supply. Critics highlight that 98% of gold investments are "unallocated" paper claims via ETFs, prone to counterparty risks like those exposed in past banking scandals. Geopolitical conflicts, such as ongoing Middle East tensions or U.S.-China trade wars, could restrict access, echoing 2022 supply chain disruptions. Gold prices, already up 70% in 2025 to $4,500/oz, are forecasted by mainstream analysts like Goldman Sachs and J.P. Morgan to hit $5,000-$5,400 by end-2026, driven by central bank buying and inflation fears. Bullish outliers predict $6,000-$8,000, but $10,000-$15,000 would require severe shocks like a dollar collapse or major wars—scenarios not impossible but far from inevitable.