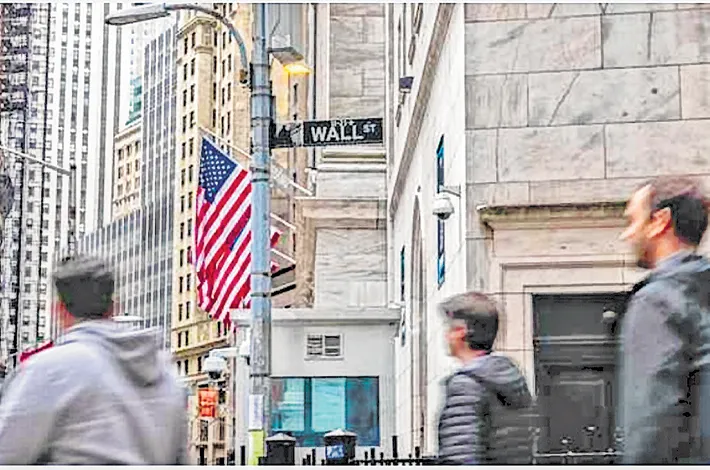

Global brokerages raise recession odds; J.P.Morgan sees 60% chance

05-04-2025 12:00:00 AM

J.P.Morgan ratcheted up its odds for a U.S. and global recession to 60%, as brokerages scrambled to revise their forecast models with tariff distress threatening to sap business confidence and slow down global growth, Reuters reported.

The Trump administration imposed tariffs on dozens of countries earlier this week. China retaliated on Friday with its own levies on U.S. goods, adding to worries about an escalating trade war and wreaking havoc on global financial markets.

J.P.Morgan said it now sees a 60% chance of the global economy entering recession by year end, up from 40% previously.

"Disruptive U.S. policies have been recognized as the biggest risk to the global outlook all year," the brokerage said in a note on Thursday, adding that the country's trade policy has turned less business friendly than anticipated.

"The effect ... is likely to be magnified through (tariff) retaliation, a slide in U.S. business sentiment and supply-chain disruptions."

S&P Global also raised its "subjective" probability of a U.S. recession to between 30% and 35%, from 25% in March.

Last week, Goldman Sachs also raised the probability of a U.S. recession to 35% from 20%, noting economic fundamentals were not as strong as in the previous years.

HSBC said on Thursday that the recession narrative will gain traction, but added some of this is already "priced in".

"Our equity market implied recession probability indicator suggests equities are already pricing in (about) 40% chance of a recession by the end of the year," HSBC analysts added.

Other research firms including Barclays, BofA Global Research, Deutsche Bank, RBC Capital Markets and UBS Global Wealth Management also warned the U.S. economy faces a higher risk of slipping into a recession this year if Trump's new levies remain in place.