Hyd Cybercrime crackdown freezes multiple bank accounts

07-01-2026 12:00:00 AM

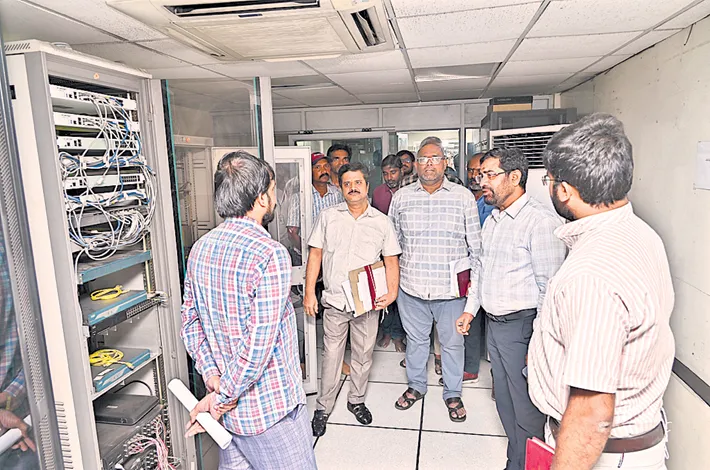

In a massive crackdown on online frauds, bank accounts of several citizens across the city have been frozen, as the Hyderabad Cybercrime Police take strict measures against digital crimes. Authorities announced that any account linked, even indirectly, to cyber frauds or illegal digital transactions will be frozen during ongoing investigations.

While the objective is to safeguard financial systems from fraud networks, the move has inadvertently affected many ordinary citizens, leaving them with blocked accounts, halted business transactions, unpaid EMIs, and frozen savings, despite having no direct connection to any scams.

Cybercrime officials cited a significant rise in online frauds involving fake investment schemes, illegal instant loan apps, online gaming and betting proceeds, and cryptocurrency transactions, particularly USDT purchases routed through compromised accounts. Police said many unsuspecting individuals end up as “money mules,” where their accounts are used temporarily to transfer illicit funds. Common triggers include fake business loan schemes, unverified business payments, online betting receipts, and cryptocurrency transactions using cyber fraud money.

Officials also highlighted that selling or lending one’s bank account is a criminal offense under the IT Act, Bharatiya Nyaya Sanhita (BNS), and the Prevention of Money Laundering Act (PMLA). Even unintentional involvement can lead to arrests, criminal cases, credit score damage, and complications in jobs or passport and travel document processing.

Among those affected, Priya V, a 25-year-old Community Manager from Madhapur, shared her ordeal: “I had my bank account blocked exactly after receiving the salary. Later I discovered that the buyer’s account was linked to a cyber fraud case. I had nothing to do with any scam, but my entire account was blocked. Now, I have my rent and the EMIs, everything stuck.”

Similarly, Swetha Narayanan, a 29-year-old Deloitte employee, said, “I also had the office and client-related money in the bank and two days later, my account was frozen because the buyer’s funds were suspected to be linked to an online fraud somewhere else connected to the previous payments I’ve made.”

Police have issued advisories urging citizens to remain vigilant about the payments they make. DCP (Cyber Crimes) V. Aravind Babu said the alert is part of increasing public awareness as cybercriminals increasingly exploit innocent individuals.

If an account is frozen, citizens are advised to first approach their bank to identify the police authority involved and then submit verification documents at the concerned police station.

Accounts are unfrozen only after official clearance from all investigating authorities. Citizens have also been urged to report suspicious requests for bank details to the 1930 cybercrime helpline or via cybercrime.gov.in.