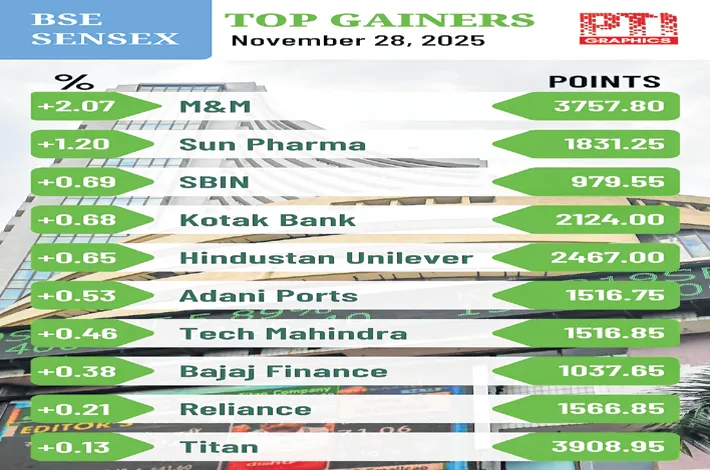

Markets steady but subdued, volatility keeps investors on edge

29-11-2025 12:00:00 AM

FPJ News Service mumbai

Indian equities ended virtually unchanged on Friday, displaying firmness despite sharp swings through the session. Selective profit-taking emerged across the broader market after the recent upswing, keeping benchmark indices range-bound as investors turned cautious ahead of key macroeconomic data.

The 30-share BSE Sensex inched down 13.71 points to close at 85,706.67, having oscillated 392 points between a high of 85,969.89 and a low of 85,577.82. The NSE Nifty slipped 12.60 points to finish at 26,202.95. Underlying sentiment, however, stayed supported by progress in India–US trade negotiations and sustained strength in heavyweight sectors such as automobiles, financials, and pharmaceuticals.

A tech-driven rally in global markets and growing expectations of an imminent US Federal Reserve rate cut further anchored confidence. With GDP and IIP prints due shortly, analysts expect the numbers to reaffirm India’s improving macro trajectory. Dr V. K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, highlighted a key paradox in the current market.

“Despite indices touching new highs, a majority of retail investors—especially those who entered after the Covid-era crash—are still sitting on losses,” he said. “Their overexposure to smallcaps, driven by the assumption of perpetual outperformance, has hurt returns.”

He noted that for retail investors to participate meaningfully in the rally expected in 2026, led by stronger earnings growth, they must shift focus towards largecaps and high-quality midcaps. While frontline indices have notched fresh peaks, the Nifty Smallcap Index remains nearly 9% below its record high, reflecting weak earnings momentum and stretched valuations. “Smallcaps are likely to continue underperforming in the near to medium term,” he cautioned.