Sentiment cautious amid risks of disruptive capital outflows

04-06-2025 12:00:00 AM

According to economic gurus, risks of disruptive capital outflows are on the rise in emerging-mkts, including India

FPJ News Service mumbai

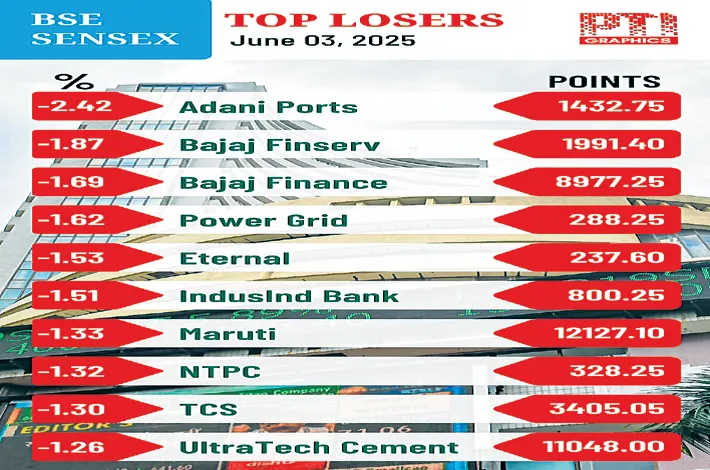

Indian markets remained in negative terrain on Tuesday amid mixed global cues, geopolitical issues, and a volatile currency market led by a weak US dollar. The 30-share BSE Sensex lost 636.24 points to settle at 80,737.51. The NSE Nifty plunged 174.10 points or 0.70 per cent to 24,542.50.

“Profit booking is evident across sectors, except for real estate stocks, supported by expectations of an interest rate cut by the RBI. Mid- and small-cap stocks are experiencing relatively less consolidation than large caps due to better earnings growth & moderation in premium valuation. While short-term consolidation is likely to persist, strong domestic oriented players are estimated to provide outperformance against external volatility,” pointed out Vinod Nair, head of research at Geojit Investments.

According to economic gurus, risks of disruptive capital outflows are on the rise in emerging-markets, including India. In most emerging-market economies, bilateral US dollar exchange rates have appreciated in 2025, especially since April, with a strong rise in the Brazilian real, the Mexican peso and the Taiwanese dollar, as investors reduced their exposure to US assets.

FIIs offloaded equities worth Rs 2,853.83, while domestic institutions bought equities worth Rs 5,907.97 crore. “The ongoing foreign fund outflows, coupled with weak global cues such as geopolitical tensions and uncertainty over trade deals, are adding pressure to the markets,” Ajit Mishra-SVP, Research, Religare Broking Ltd, said.