Trump’s tariffs self-destructive warns Rangarajan

13-09-2025 02:18:28 AM

Rangarajan’s Take

The eminent economist urged a return to freer trade principles, warning that fragmented economic blocs could undermine the vision of a unified global market.

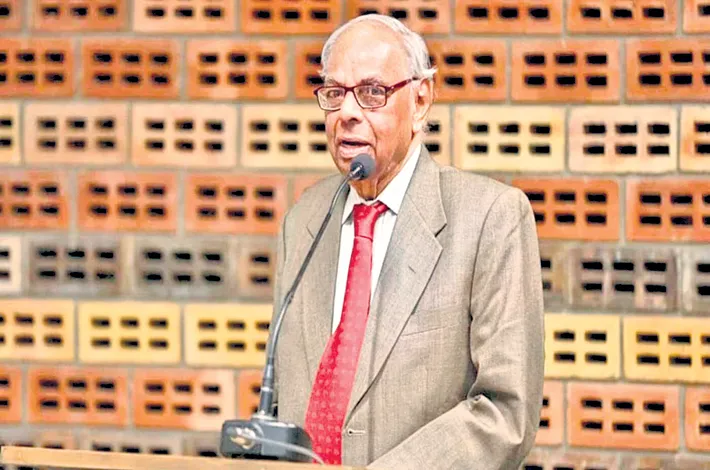

In a pointed critique of U.S. President Donald Trump's aggressive protectionist agenda, former Reserve Bank of India (RBI) Governor C Rangarajan declared on Friday that certain economic policies, particularly sweeping tariffs, are not only stalling global growth but also proving "self-destructive" for the American economy itself. Speaking at the 15th Convocation of the ICFAI Foundation for Higher Education here, the eminent economist urged a return to freer trade principles, warning that fragmented economic blocs could undermine the vision of a unified global market.

Rangarajan, who served as RBI Governor from 1992 to 1997 and later chaired the Prime Minister's Economic Advisory Council, as well as Governor of AP, did not mince words. "These policies have brought global economic trends to a standstill," he said, referring to Trump's "Liberation Day" tariffs announced in April, which imposed a baseline 10% duty on imports from all countries, escalating to 25-50% on nations like India, China, and the European Union. "Hopefully, good sense will prevail, and U.S. policymakers will realize the policies they want to pursue are self-destructive." He emphasized that India, as one of the hardest-hit nations, stands to lose significantly, but the ultimate casualty could be the interconnected world economy Trump once helped shape.

The timing of Rangarajan's remarks could not be more poignant. Just days earlier, on September 10, The New York Times published an opinion piece lambasting Trump's interventions in sectors like semiconductors as treating the economy "like his family business," bypassing congressional oversight and risking long-term vulnerabilities. Trump's use of the International Emergency Economic Powers Act (IEEPA) to justify these measures—citing a $918 billion U.S. trade deficit as a "national emergency"—has drawn fire from economists worldwide. A Peterson Institute for International Economics (PIIE) working paper released in July modeled five scenarios for the tariffs' fallout, projecting U.S. GDP contraction by up to 1.2% in the high-tariff-with-retaliation case, alongside a 0.5-1% global growth shave.

Rangarajan's intervention echoes a chorus of concern from Indian economic heavyweights. Former RBI Governor Raghuram Rajan, in multiple 2025 interviews, labeled the tariffs a "self-goal," arguing they inflate U.S. consumer prices without reviving manufacturing. In an August India Today TV discussion, Rajan highlighted the "deeply distressing" 50% duties on Indian shrimp and textiles, which threaten livelihoods for thousands of small exporters in Gujarat and beyond. "Trade, investment, and finance have been weaponised," Rajan said, urging India to reassess discounted Russian oil imports that partly provoked the hikes. Current RBI Governor Sanjay Malhotra, responding to Trump's August jibe calling India's economy "dead," countered that it contributes 18% to global growth—outpacing the U.S.'s 11%—with FY25 projections at 6.5% versus the IMF's 3% global baseline.

To contextualize Rangarajan's alarm, Trump's tariff odyssey began in earnest on April 2, 2025, when he invoked IEEPA to declare foreign practices like currency manipulation and value-added taxes a threat to U.S. sovereignty.

The initial 10% universal tariff, effective April 5, ballooned into targeted levies: 25% on steel and aluminum, 50% on autos from India and Mexico, and punitive 25% add-ons for Russian energy buyers like India. By July, Trump signed a policy bill renewing these measures, tying them to tax cuts he claims will ignite a "golden age." Yet, August financial data paints a bleaker picture: U.S. job gains dwindled to 114,000 in the latest report, inflation ticked up to 3.2%, and GDP growth slowed to 1% year-over-year, per J.P. Morgan estimates.

For India, the sting is acute. Exports to the U.S.—valued at $83 billion in FY24—face erosion in key sectors. The Federation of Indian Export Organisations estimates a 15-20% drop in textile shipments alone, while shrimp farmers in Andhra Pradesh brace for factory closures. Rangarajan noted India's vulnerability stems from its $36 billion trade surplus with the U.S., but he pivoted to a broader vision: "The emergence of different blocks—within which trade is freer—is inevitable, but the ultimate goal must be one large world with freer trade." He alluded to groupings like BRICS without naming them, suggesting they offer short-term buffers but risk entrenching divisions.

Globally, the tariffs have spurred retaliation. The EU imposed 20% countermeasures on U.S. whiskey and motorcycles in May, while China devalued the yuan by 2% in response. A PIIE scenario incorporating asset risk premiums forecasts a U.S. dollar depreciation mirroring the 3% post-announcement dip in April, potentially fueling imported inflation. Economists like Rajan warn this "shock and awe" approach.

Rangarajan, 92, brings unparalleled gravitas to the debate. A key architect of India's 1991 liberalization, he navigated the balance-of-payments crisis, introducing the Liberalised Exchange Rate Management System that stabilized the rupee. His tenure at RBI fostered external viability, and as PMEAC chair, he influenced reports on inflation and growth. Today, he ties these lessons to "Viksit Bharat," India's developed-nation ambition by 2047. "It's not just statistical—it's a transformative journey requiring government and society," he said, implicitly contrasting it with Trump's insular strategy.